When Was Insurable Interest Exist In A Life Insurance Policy

For a life insurance contract to be valid the insurable interest must exist at the time the policy is purchased. Proof must be presented at application as well as at the end of the policy when the insured has passed away.

What Is Insurable Interest Definitions Permanent Life Insurance Universal Life Insurance

It exists when the beneficiary derives any financial benefit from the continuous existence of the insured and consequently suffers a financial loss in case of hisher demise.

When was insurable interest exist in a life insurance policy. In the case of life insurance it refers to the potential needs the beneficiary will require from the financial loss of the insured person. It mustcontinue for the lifeof the policy. Insurable Interest on Hong Kong Life Insurance Plans.

It must existwhen a claim is submitted. So if you have an insurable interest towards a particular property it means upon it damage you will suffer financially or emotionally. Without an insurable interest the policy can be void or denied.

A life settlement is when a policyowner sells a life insurance policy to an investor and its a perfectly legal transaction even if the new policyowner has no insurable interest in the life of the insured. The owner of the life insurance policy or certificate holder under a group policy who enters or seeks to enter into a viatical settlement. When must insurable interest exist in a life insurance policy.

The 1774 Life Assurance Act imposes a requirement for the policyholder to show an insurable interest in the life insured at the time the contract is taken out. Insurable interest can be an object which if damaged or destroyed would result in financial hardship for the policyholder. This is different from a policy.

Insurable interest is simply defined as the level of hardship financial dependency and otherwise a person will suffer from the loss of something or someone they have insured. In life insurance insurable interest must exist between the policyowner and the insured at the time of the application. For example a husband who takes out a policy on his wife and names himself as the beneficiary can prove insurable interest at the time of application.

Insurable interest means that the policyholder benefits more if the insured person stays alive than if they pass away. Life insurance is designed to help your family or loved ones overcome the financial burden of your death and maintain their quality of life without your income. Insurable interest is a nonnegotiable aspect of life insurance policies.

In that context insurable interest exists when you are financially benefiting from the insureds ongoing health and safety. Therefore if you would like to financially protect someone that does not have an insurable interest in your life you can purchase a life insurance policy on your life naming that person as the beneficiary the most common arrangement. In life insurance one or more beneficiaries gets paid a death benefit if you pass away and the policyholder the person who purchased the policy gets to name the beneficiaries.

Insurable interest underpins all insurance coverage but its critical with respect to life insurance. In dealing with life insurance a person is deemed to have insurable interest when the purchaser has a reasonable expectation of profit or benefit from the continued life of the insured. A very basic definition of insurable interest is that it is said to be the relationship with the subject of the insurance which is.

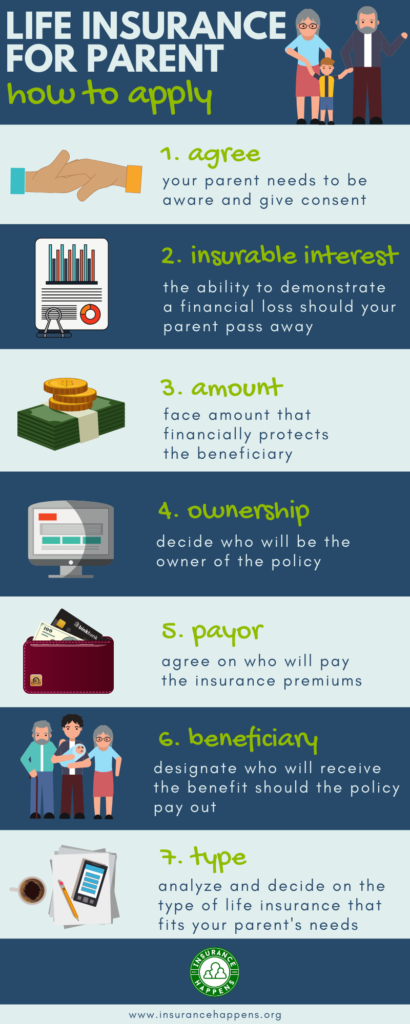

One of the major components of a life insurance application in Hong Kong is the ability of the individual purchasing the policy to prove insurable interest. It does not have to continue once the policy is in force. Said another way you are at risk of financial loss if the insured were to pass away.

Insurable interest is the basis of all insurance policies. Thats because insurable interest must exist only. Insurable interest is the key logic driving life insurance contracts.

It is a term used to define the relationship between the insured and the beneficiary nominee. This interest can be created in the following circumstances. And because someone gets paid in the event of an insured persons death theres a legal requirement that you have an insurable interest in someone you want to buy a life insurance policy on.

Insurable interest must existonly at the time the applicant enters into a life insurance contract. Alabama Code 1975 27-14-3 f requires that an insurable interest shall exist at the time the contract of personal insurance becomes effective but. Every state requires that an insurable interest exist at the time of application.

Always but its a requirement that applies to the owner with the person being insured. Insurable interest only needs to exist when a life insurance policy is initially issued. If no insurable interest existswhen a policyowner buys a life insurance policy the contractmay still be enforced.

When you have an insurable interest in something or someone it means that in case of any injury harm or death you will suffer losses or any other type of suffering including emotional. It is the duty of the policy owner to prove that they have an insurable interest in the insured party.

What Is Life Insurance And How Does It Work Money

Https Www Piafl Org Resource Collection 7c4287b4 4232 4485 9d7d 05d8c71d491c 2004 Insurableinterest Pdf

What Is Insurable Interest In Life Insurance Everything You Should Know

What Does Insurable Interest Mean In Life Insurance

What Is An Insurable Interest In Life Insurance Definition Faqs

/WhenMustInsurableInterestExistinaLifeInsurancePolicyMay262021-65b9b5a62d38425fbdaaa3a53f11397d.jpg)

When Must Insurable Interest Exist In A Life Insurance Policy

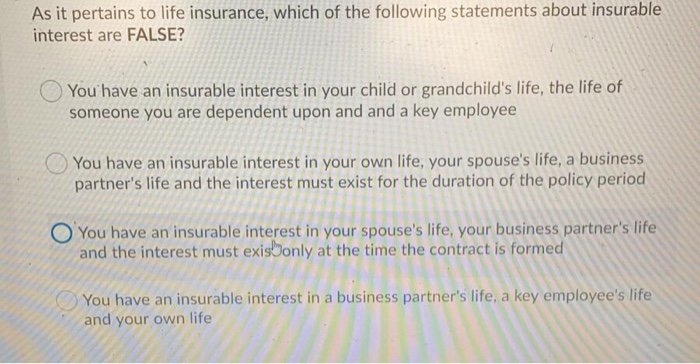

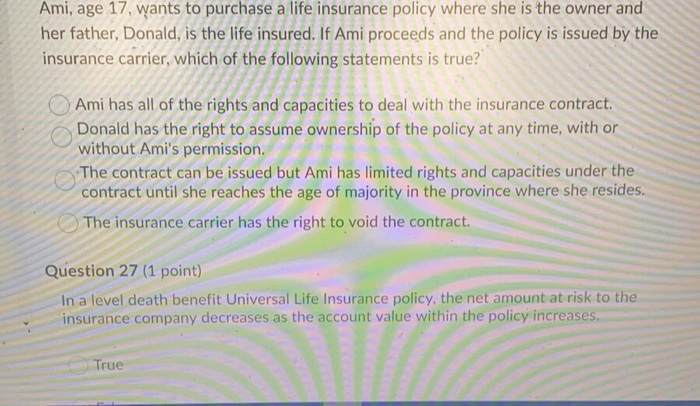

As It Pertains To Life Insurance Which Of The Chegg Com

As It Pertains To Life Insurance Which Of The Chegg Com

Insurance Lingo Your Quick Reference Guide Infographic Life And Health Insurance Insurance Marketing Insurance Humor

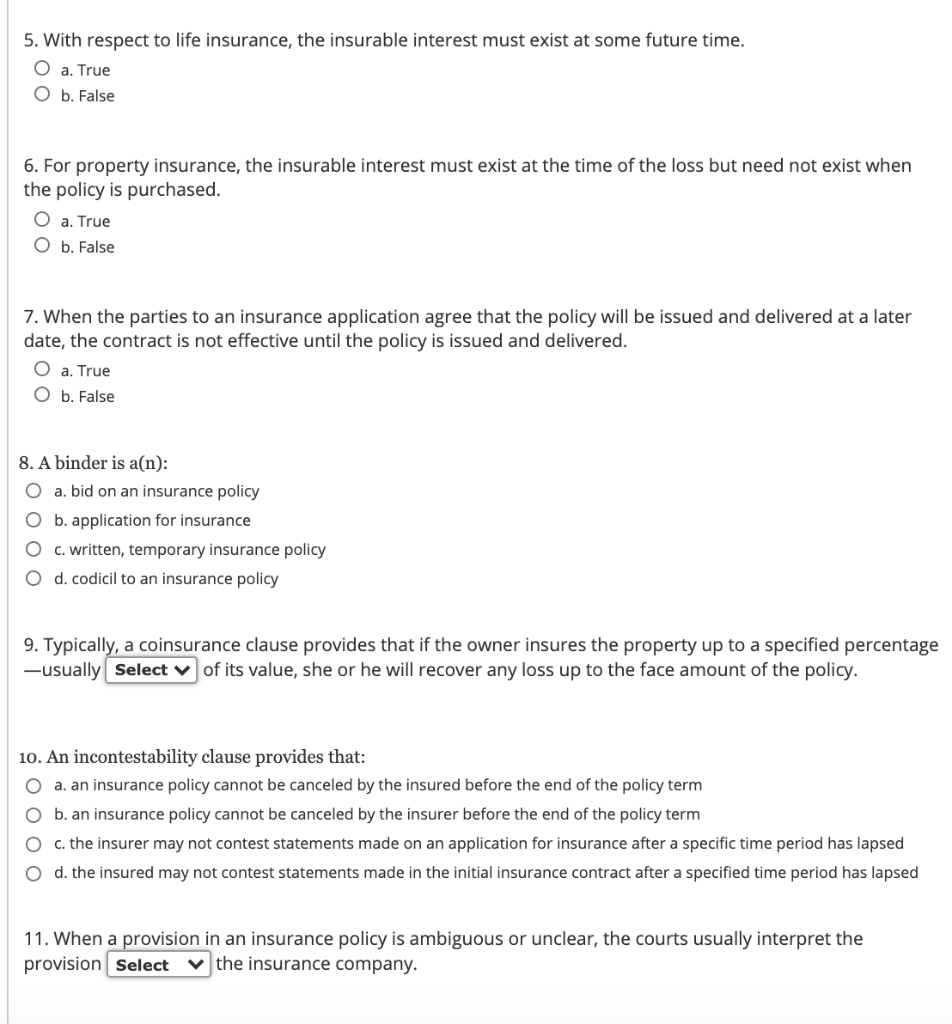

5 With Respect To Life Insurance The Insurable Chegg Com

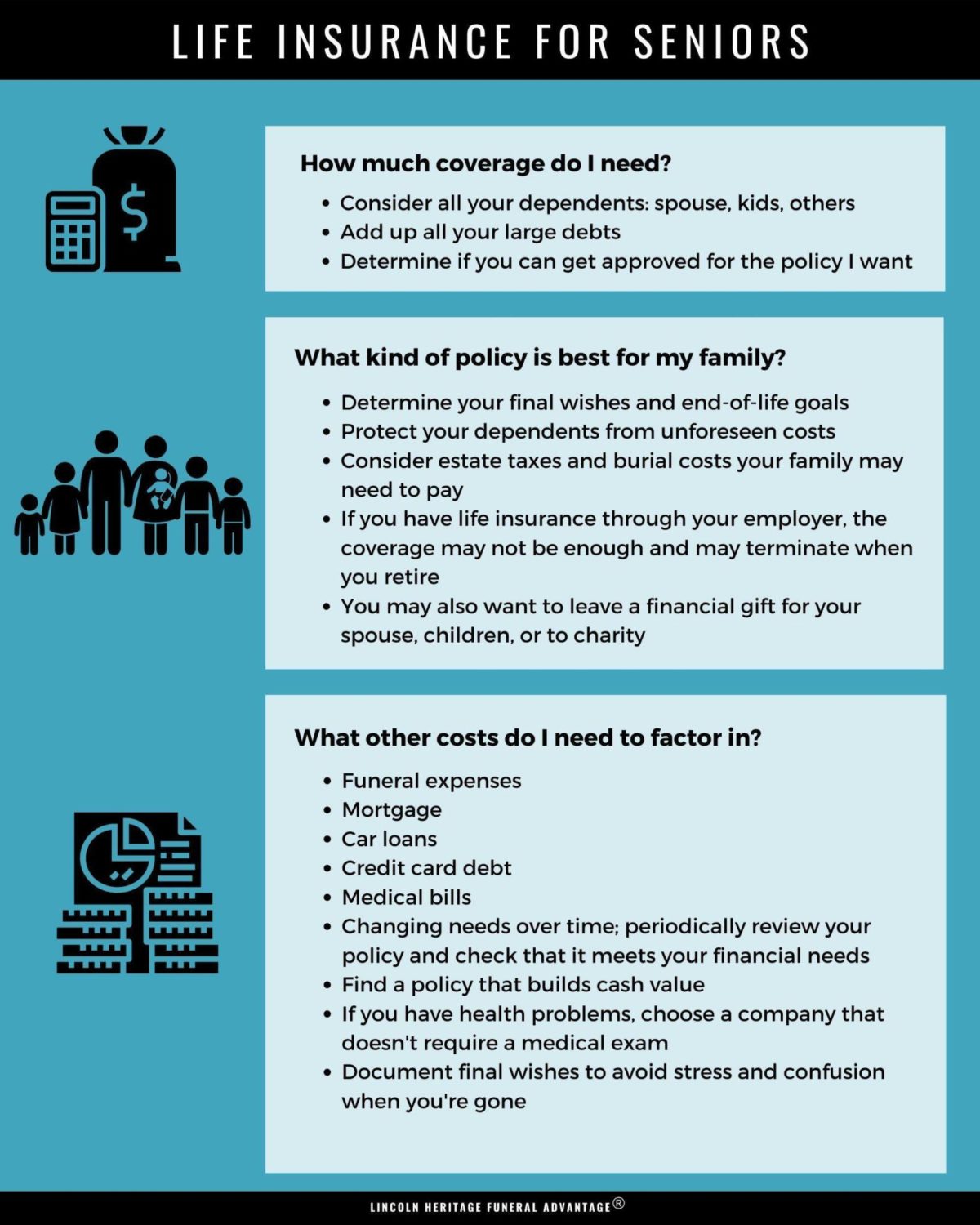

Best Life Insurance For Seniors

History Of Life Insurance Continuing Education Insurance School Of

Common Types Of Life Insurance Infographic Life Insurance Quotes Life And Health Insurance Whole Life Insurance

As It Pertains To Life Insurance Which Of The Chegg Com

The Ins And Outs Of Life Insurance Policy Ownership Coastal Wealth Management

What Is Insurable Interest In Life Insurance Valuepenguin

Which Of The Following Statements Is Not Typically Chegg Com

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Post a Comment for "When Was Insurable Interest Exist In A Life Insurance Policy"