When Does Insurable Interest Exist In A Life Insurance Policy

Do note that even with an insurable. The prevailing although not the universal rule is that in the ab sence of a statute to the contrary a person competent to contract has an insurable interest in his own life.

What Is Life Insurance And How Does It Work Money

Alabama Code 1975 27-14-3g further.

When does insurable interest exist in a life insurance policy. For life and health insurance such insurable interest may be described in two ways. Insurable interest underpins all insurance coverage but its critical with respect to life insurance. Purchasing life insurance without an insurable interest is a rare occurrence.

If no insurable interest exists when a policyowner buys a life insurance policy the contract may still be enforced. If there is no insurable interest there is no life assurance policy. And may make the policy payable.

Insurable interest means you have an interest in the continuation of the life of the person whos insuredit could be. It does not place any restrictions on a subsequent change of beneficiary for a validly issued life insurance policy and the Court in interpreting the statute as it was written found that requiring an insurable interest to exist beyond the time the policy is procured andor becomes effective would require the Court to add words to the statute. It must exist when a claim is submitted.

Insurable interest only needs to exist when a life insurance policy is initially issued. In that context insurable interest exists when you are financially benefiting from the insureds ongoing health and safety. It must continue for the life of the policy.

With regards to life insurance someone having an insurable interest in you means that they would experience financial loss and hardship should you die. Insurable interest is simply defined as the level of hardship financial dependency and otherwise a person will suffer from the loss of something or someone they have insured. But if they get divorced and he remains the beneficiary he will still get the death benefit if his ex-wife dies.

What are some common personal uses of life insurance. In life insurance insurable interest must exist between the policyowner and the insured at the time of the application. In the case of life insurance it refers to the potential needs the beneficiary will require from the financial loss of the insured person.

1 with respect to insuring himself. Do I have a reasonable interest in. But it does happen and is sometimes referred to as secret life insurance policies because the insured is.

Since its obvious that a person has an insurable interest on hisher own life the beneficiaries of that policy do not need to. Every state requires that an insurable interest exist at the time of application. Policies issued on lives where there is no insurable interest are regarded as.

If there is no insurable interest the life insurance policy is void. For example a husband who takes out a policy on his wife and names himself as the beneficiary can prove insurable interest at the time of application. The insurance policy would mitigate the risk of loss if.

What is insurable interest. In life insurance a person has an insurable interest in another person when the death of that person would cause a financial emotional or another type of loss. Thats because insurable interest must exist only when the policyowner first applies for coverage.

Life insurance coverage protects you against that loss. It does not have to continue once the policy is in force. In Life insurance policies insurable interest must exist at the issue of the policy.

You automatically have an unlimited insurable interest in your own life. The underwriters will determine if your named beneficiary has an insurable interest in your life. To have an insurable interest a person or entity would take out an insurance policy protecting the person item or event in question.

Insurable interest is the key element in the structure of a life assurance policy. Insurable interest must exist only at the time the applicant enters into a life insurance contract. Its important to mention that insurable interest must only exist at the time of the application.

What is insurable interest. They will also make sure the owner has an insurable interest in. Insurable interest can be present in many situations like marriage but it is evaluated by the insurance company during the application for the policy and before payment of the death benefit.

Therefore for someone to purchase an insurance policy on your life and be considered the beneficiary making them beneficiary-owner they must be able to demonstrate an insurable interest. In dealing with life insurance a person is deemed to have insurable interest when the purchaser has a reasonable expectation of profit or benefit from the continued life of the insured. Said another way you are at risk of financial loss if the insured were to pass away.

For instance a wife could buy life insurance on her husband and if they get divorced she may still keep the policy. A life settlement is when a policyowner sells a life insurance policy to an investor and its a perfectly legal transaction even if the new policyowner has no insurable interest in the life of the insured. It is fundamental to the policys very existence.

Insurable interest isnt necessary throughout the life of the policy or when the insured person dies. It it helps you can think of it as a question. You need to have an insurable interest to take out a life insurance policy on someone else.

Common Types Of Life Insurance Infographic Life Insurance Quotes Life And Health Insurance Whole Life Insurance

The Ins And Outs Of Life Insurance Policy Ownership Coastal Wealth Management

Unwinding An Irrevocable Life Insurance Trust That S No Longer Needed

Cash Value Life Insurance Is It Worth It Financial Samurai

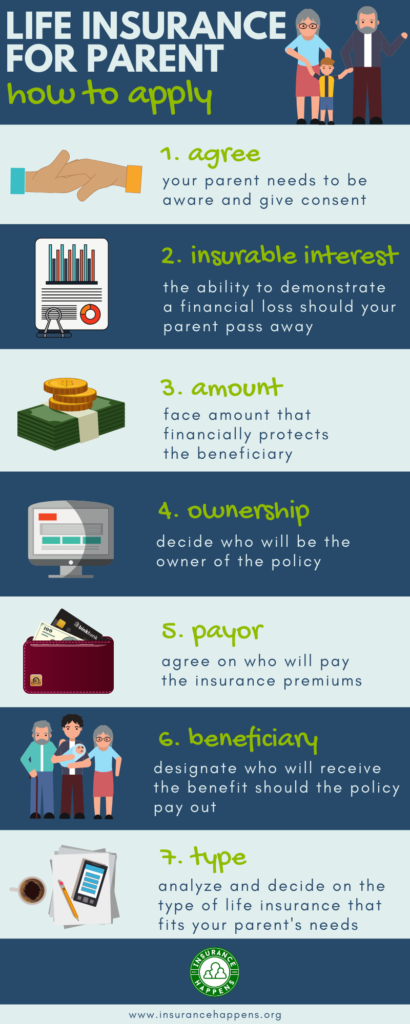

Life Insurance For Parents And How To Apply

Military Life Insurance Guide How Much What Type Where To Buy It

Life Insurance And Insurable Interest Term Life Quotacy

How Does Life Insurance Work Forbes Advisor

How Life Insurance Works Your Guide To Understanding Life Insurance

What Is Insurable Interest In Life Insurance And Why Is It So Valuable

Life Insurance Insurable Interest

Paid Up Life Insurance Explained The Insurance Pro Blog

Understanding Insurable Interest In Life Insurance

2021 Final Expense Life Insurance Guide Costs For Seniors

Insurance Lingo Your Quick Reference Guide Infographic Life And Health Insurance Insurance Marketing Insurance Humor

What Is Life Insurance And How Does It Work Money

/WhenMustInsurableInterestExistinaLifeInsurancePolicyMay262021-65b9b5a62d38425fbdaaa3a53f11397d.jpg)

When Must Insurable Interest Exist In A Life Insurance Policy

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Post a Comment for "When Does Insurable Interest Exist In A Life Insurance Policy"