What Is Imputed Life Insurance

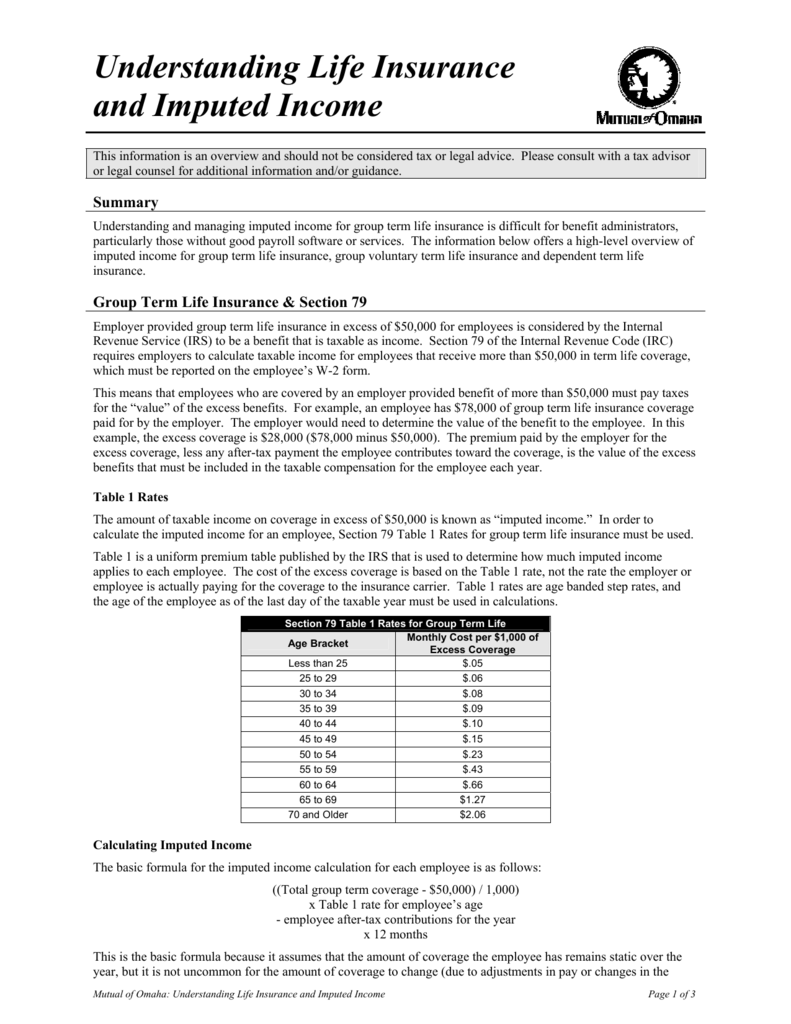

The IRS-determined value is called imputed income and is calculated from the governments Uniform Premium Table I AGE COST per 1000 for 1 month. The cost of employer-provided term life insurance on thelives of an employees dependents must be imputed to the employee unless the benefitprovided is 2000 or less.

Https Www Smu Edu Media Site Businessfinance Hr Pdf Benefits Group Life Insuranceimputed Income Calculation Benefits U Pdf La En

Anzeige Cover gaps in your retirement provisions and protect your family.

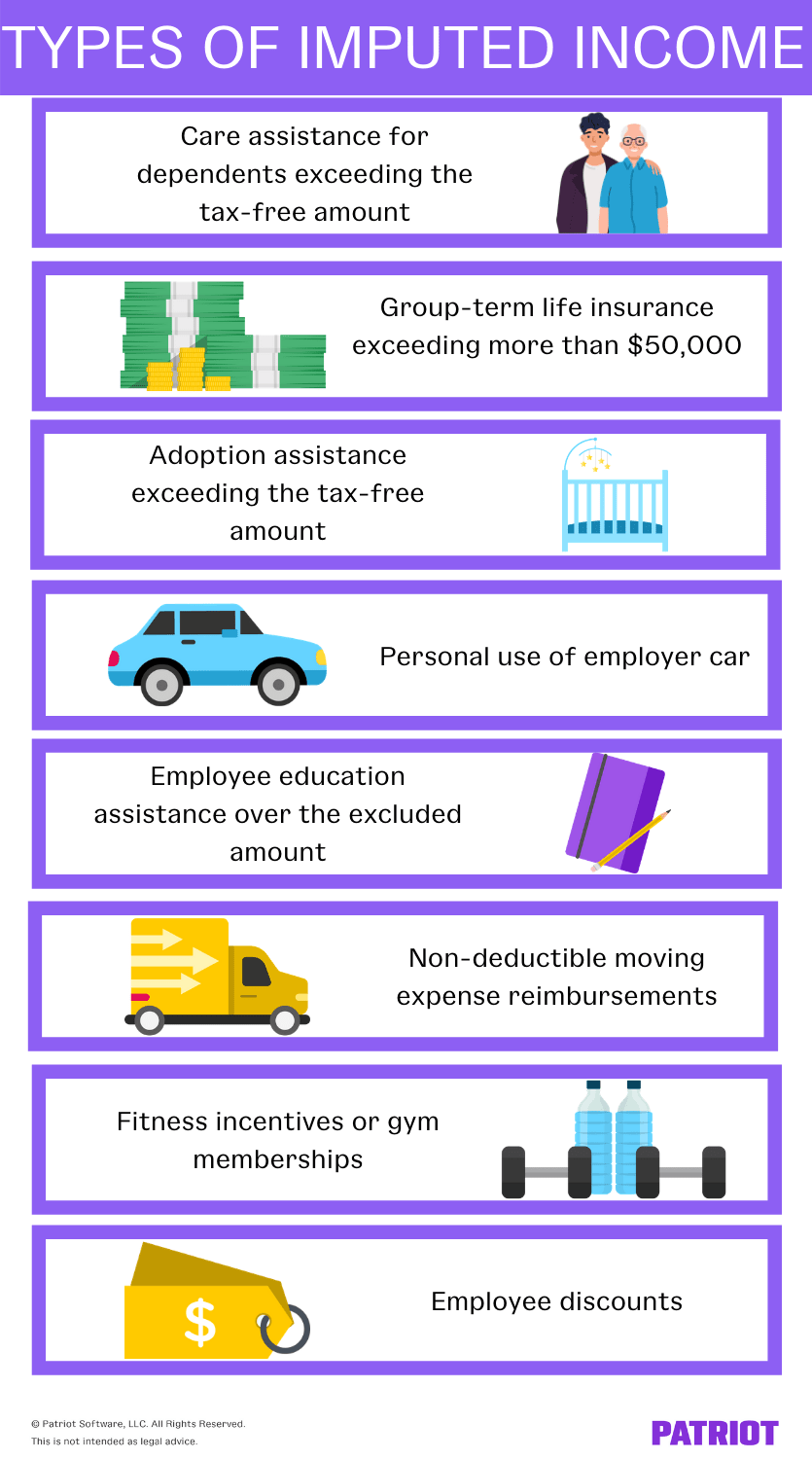

What is imputed life insurance. Anzeige Comprehensive protection for everyone whether individuals or companies. Simply put imputed income is a term constructed by the Internal Revenue Service to describe the taxable value of a group life insurance policy that a taxpayer holds. So life insurance imputed income refers to any amount paid on the cover above 50000.

Internal Revenue Code 61 stipulates most of the rules for imputed income. Because you are getting it at a reduced cost it is considered by the IRS to be of more value that you paid and as such is a taxable income per their schedule. The imputed income creates a taxable income for employees that must be reported on a W-2 tax form.

Protect your family against financial shortfalls. For your information it describes the value of benefit or service that the IRS treats as income. We offer life insurance together with our long-standing partners.

The reason it is called imputed income is because the IRS sees this employer benefit as a form of income because you are not paying the full value of the policy with after-tax dollars out of your own pocket. If you still cant access what is imputed income life insurance please leave a message below. Anzeige Comprehensive protection for everyone whether individuals or companies.

September 15 2019. Called Table I the rate per 1000 of coverage varies by age and is included in your W-2. Imputed income is the recognization of a benefit received for which the recipient did not pay.

Life Insurance Imputed Income Calculation. When it comes to group life insurance the IRS says that getting life insurance of more than 50000 is considered to be a fringe benefit. Life insurance imputed income is a commonly used phrase.

However very few people understand what it means. Protect your family against financial shortfalls. That means that it is a taxable form of income for you.

The Internal Revenue Service requires you to pay income tax on the value of any amount exceeding 50000. Answered on May 20 2013. For Dependent Life Insurance.

For example if you are 50 years old and the life insurance policy is 60000 you subtract the 50000 which leaves 10000. IMPUTED INCOME Life insurance is a tax-free benefit in amounts up to 50000. Employer provided life insurance is taxable to the employee except that the first 50000 of coverage is free of tax.

Internal Revenue Code 61 stipulates most of the rules for imputed income. If the 2000 limit is exceeded all dependent life insuranceincluding the first 2000 is taxable. It should not be construed as legal or tax advice and employers and employees or other plan participants are urged to consult their qualified advisors regarding the specific consequences of the applicable tax and other rules.

Imputed income is the recognization of a benefit received for which the recipient did not pay. Imputed income in life insurance is the dollar value of group life insurance that you either pay for at group rates or get for free from your employer that is above 50000. Anzeige Cover gaps in your retirement provisions and protect your family.

We offer life insurance together with our long-standing partners. Find the official insurance at the bottom of the website. When it comes to life insurance imputed income occurs when someone receives coverage through hisher employer where the individual does not pay for the coverage.

Amounts provided above 50000 of coverage are imputed as income based on a government rate table. For employers it is important to note imputed income life insurance because that has to go in the W-2 tax forms for each of the employees. Go to what is imputed income life insurance page via official link below.

There is a simple formula that is available which will help you calculate the amount of imputed income for life insurance so that youll know what is needed to be paid. Life insurance imputed income is the value the IRS assigns to the premiums youve paid for any group-term life insurance policy that exceeds 50000 in death benefits. When it comes to life insurance imputed income occurs when someone receives coverage through hisher employer where the individual does not pay for the coverage.

Group-Term Life Insurance Imputed Income This information is provided for purposes of general education. Follow these easy steps.

Group Term Life Insurance A Compliance Primer Crystal Company

Http Www Jrgadvisors Net Module Catalog Documentfilefile Mobile Id 426

What Is Imputed Income On Life Insurance The Insurance Pro Blog

Https Mymohawkbenefits Com Images Life Retirement Imputed Income Explanation Pdf

Smart Benefits Imputed Income For Group Term Life Insurance Golocalworcester

Pin By Susan Desilva On Work In 2021 Trial Balance Balance Sheet Template Accounting

Does Imputed Income Affect Your Contributory Life Insurance Plan Nis Benefits

Understanding Life Insurance And Imputed Income

What Is Imputed Income Payroll Definition Examples

Rent Vs Imputed Rent Go Curry Cracker Free Health Insurance Rent Rent Vs Buy

How Imputed Income Reporting Works With Your Contributory Life Insurance Plan

It Is The Heisenberg Principle Of Remembrance The Mere Act Of Observing A Memory Changes That Memory S Meaning Attitude Quotes Quotes Truth

What Is Imputed Income For Life Insurance Business Stock Photos Managing Your Money Money Habits

How Imputed Income Reporting Works With Your Contributory Life Insurance Plan

Section 79 Employer Paid Term Life Ghb Insurance

U S Annual Healthcare Spending Is A Stunning 3 4 Trillion Says Study Health Care Healthcare Solutions Health Care Reform

Nbw Pest Control Singapore Pest Control Pest Control Services Pest Removal

Post a Comment for "What Is Imputed Life Insurance"