What Is The Basic Purpose Of Insurance

These include providing for ones final expenses such as funeral costs and serving as a financial cushion for ones family. When you are not protected ie not insured you will not be compensated for.

Insurance Ad I Did For An Health Insurance Agent For Sample Purpose Only By Courtney Martinez Health Insurance Agent Health Insurance Broker Insurance Ads

The function of insurance is to safeguard against financial loss by having the losses of the few paid by contributions of the many that are exposed to the same risk.

What is the basic purpose of insurance. The fundamental purpose of insurance is to spread out the risk of individual investments among many parties to reduce the risk to any individual member of the pool in the event that an investment fails. Therefore it is easy to see how the insurance industry plays an important role in our nations economy. What Is the Purpose of Life Insurance.

Insurance helps to provide protection against these financial losses. In Pennsylvania car owners are required to purchase automobile insurance. Thats basically what the purpose of insurance is to provide you with a form of protection against a possible risk.

For example when you buy life insurance you are protecting your dependents from financial hardship if. Another reason for purchasing insurance is that some insurance is required by law. The main intention is to make sure that other.

Business insurance helps protect your business financial assets intellectual and physical property from. The asset would have been created through the efforts of the owner in the expectation that either through the income generated there from or some other output some of his needs would be met. Its as simple as that.

Insurance companies invest premium dollars collected annually in a wide range of investments. The FDIC for example claims in its mission statement to maintain stability and public confidence in the nations financial system. You must provide your insurance information when registering a car.

The insured insurance company will pay the insured for a covered loss and seek reimbursement from the party at fault Subrogation- example on auto- UninsuredUnderinsured Motorist The insurers right to recover its claim payment to an insured from a negligent 3rd party is known as. The quest for coverage in a policy usually begins with an Insuring Agreement. Life insurance policies are designed to achieve several aims.

The business of insurance is related to the protection of the economic value of assets. Its aim is to reduce financial uncertainty and make accidental loss manageable. Understanding auto insurancethe basics Auto insurance is a contract between you and the insurance company that protects you against financial loss in the event of an accident or theft.

No insurance no registration. Consumers and business owners dont buy insurance in order to not have coverage though when you shop on the basis of fast easy and cheap thats all too often what you get. Technically the basic function of property casualty insurance is the transfer of risk.

Aside from state laws making it mandatory having the proper coverage can help motorists avoid financial hardships resulting from automobile accidents. As I mentioned earlier the basic purpose of insurance is risk management. As many courts have said the purpose of insurance is to insure.

The basic purpose of insurance is to protect you from losses. In exchange for your paying a premium the insurance company agrees to pay your losses as outlined in your policy. A life insurance policy is a policy people take out with a life insurance company to provide a sum of money when they die.

Most commonly states require drivers to have a liability policy in order to operate vehicles legally. Different Purposes of Car Insurance. C Protect you from losses.

Therefore the answer is. Purpose and Need of Insurance. The purpose of insurance is to help protect your business from these risks.

When you are protected you will be compensated for your loss. In other cases homeowners insurance or insurance offered as part of your credit card membership may give you some protection against financial loss in the event your belongings are lost or damaged. A comprehensive travel insurance plan supplements those benefits with secondary coverage that can offer additional protection.

Every asset has value.

Health Insurance Agents Recruitment Health Insurance Agent Insurance Agent Insurance

Why You Should Not Focus On Finding The Cheapest Plan How To Plan Homeowner Humor Renew Car Insurance

What Is Differential Claim Insurance What Is Differential Claim Insurance A Claim Is The Basic Action Taken By An Insurance Policy Holder Who Wan Em 2020 Pinterest

What Is The Importance Of General Insurance Cover Insurance Health Insurance Companies Private Health Insurance

Benefits Of Life Insurance Benefits Of Life Insurance Life Insurance Insurance

Money Is The Megaphone Of Identity Money Matters Money Identity

What Purpose Does A Motor Insurance Serve Insurance Motor Purpose

Life Insurance Tips Info You Must Know How To View Life Insurance As An Investment Tool Investment Tools Insurance Investing

What Determines The Cost Of Your Auto Insurance Auto Insurance Companies Car Insurance Car Insurance Tips

Tips For Buying Business Insurance Construction Contractors Life Insurance Marketing Life Insurance Facts Business Insurance

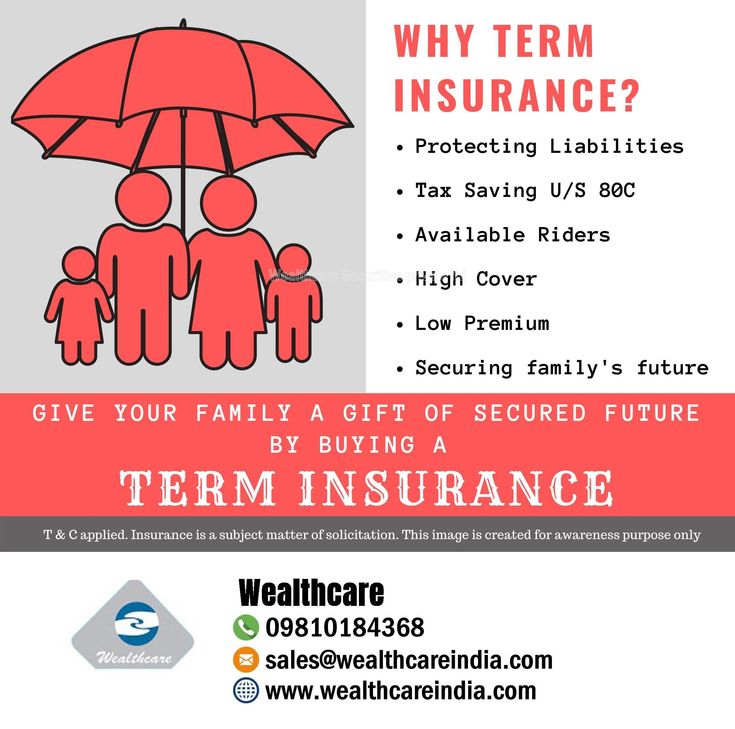

Benefits Of Term Insurance In 2021 Term Insurance Life Insurance Life Insurance Policy

Why Life Insurance Because Your Family Is Worth It Life And Health Insurance Life Insurance Marketing Ideas Life Insurance Facts

Interesting Tidbit About Life Insurance Interesting Tidbit About Life Insurance Insurance Int In 2020 Life Insurance Facts Whole Life Insurance Farmers Insurance

Insurance Ad I Did For An Health Insurance Agent For Sample Purpose Only By Courtney Martinez Health Insurance Agent Insurance Ads Health

I Am Young And Don T Need Insurance Event Planning Quotes Insurance How To Plan

Post a Comment for "What Is The Basic Purpose Of Insurance"