Usaa Hybrid Long Term Care Insurance

However through their website they offer long term care insurance from John Hancock Life Insurance Company. Learn more about long-term care and the types of protection we offer.

By that we mean it may be worth paying a bit more if you are able to buy coverage from a financially-superior insurance plan.

Usaa hybrid long term care insurance. Go to does usaa offer long term care insurance page via official link below. Only 13 of wealthy people purchase the coverage even though over 30 of men and 40 of women can afford it. Significant Differences in Coverage.

Get direct access to does usaa offer long term care insurance through official links provided below. A unique feature of this plan is the option to. A man of 50 years old has to pay 12895 in annual premiums for 10 years.

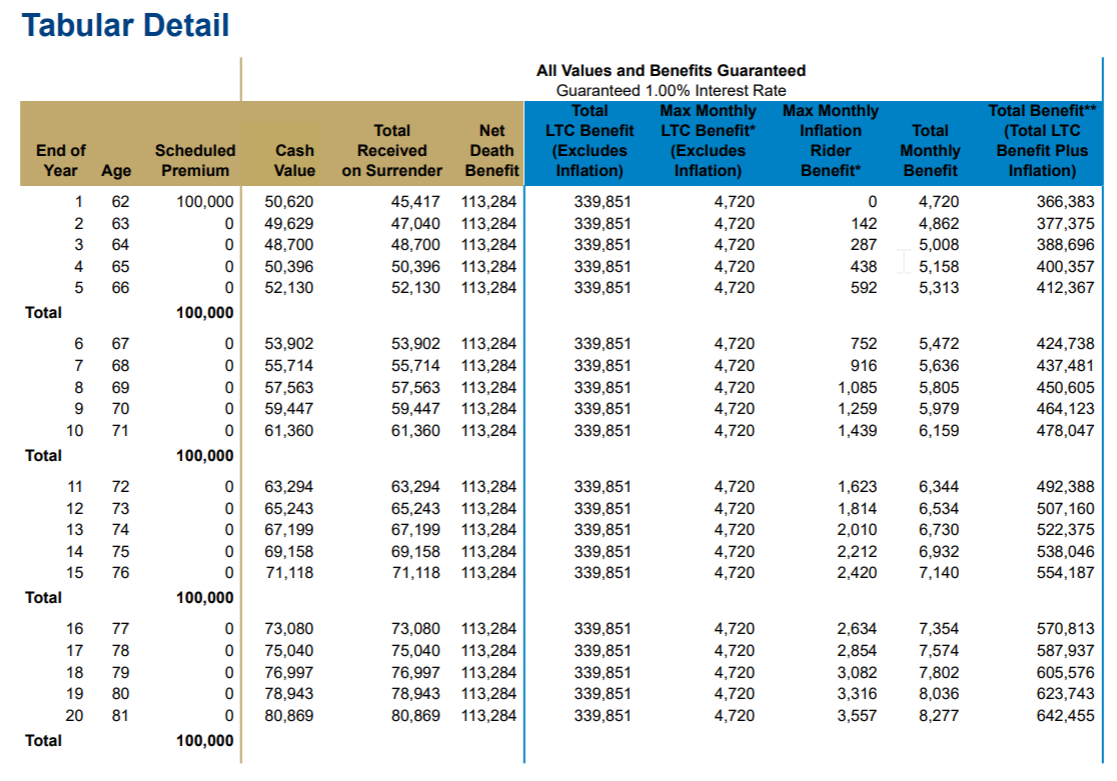

Medical underwriting is usually less stringent with hybrid long term care insurance. The companys hybrid life insurance and long-term care insurance plan offers customers LTC coverage if needed or dependents can receive a payout. They combine the benefits of life insurance or an annuity with long term care benefits.

Easier to qualify for coverage. Call 800-531-1426 to speak with a specialist or for more information visit USAAs long-term care page. Long term care insurance - USAA Community - 177829.

Is this spending surge smart. You can contact a USAA agent call their home office or visit their website for more information. The typical statistics and probabilities quoted for long-term care insurance marketing are based on survey data thats over 25 years old.

Thats almost five times the number of standalone long-term care policies about 55000 sold in the same period. USAA does not offer their own Long Term Care Insurance coverage underwritten by USAA Life Insurance Company. On the other hand a woman of 50 will pay 11568 and a woman of 65 will pay 17015 Click to rate this post.

Find the official insurance at the bottom of the website. That can add up to. Hybrid combined or linked long term care policies typically feature a life insurance component with a long term care rider.

Some policies also ensure a small death benefit even if you use up the policys long-term care insurance benefits. USAA believes that everyone should have a plan for managing their long-term care needs. Follow these easy steps.

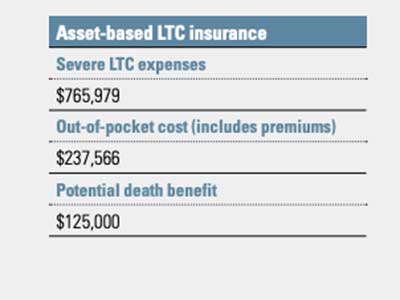

A Securian hybrid policy providing 6000 long-term care benefits for 3 years or a total of 216000 benefits. The Washington Long-Term Care Program is the nations first public state-operated long term care insurance program. LTC hybrid products guarantee return of premium either in the form of long term care benefits or a death benefit.

You can buy a hybrid long term care insurance policy by paying a one-time lump sum premium or over a set period of time. We can help review your options and help you make the best decision for your needs. Hybrid Long Term Care Insurance Hybrid long term care policies are the popular alternative to long term care insurance.

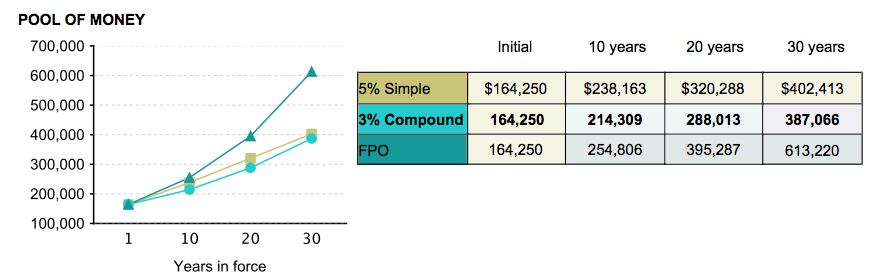

Hybrid Long-Term Care Insurance policies can allow you to receive a 100 preservation of premiums paid while simultaneously providing significant leverage 3-8x in the event you need Long-Term Care services. Hours of Operation Opens Popup Layer. What Is Hybrid Long Term Care Insurance.

You can choose a benefit period of 2 3 5 or 7 years. You can expect to pay at least 75000 in a lump sum to add long-term care coverage to your permanent life insurance. Traditional stand-alone policies and combination long-term care and life insurance policies.

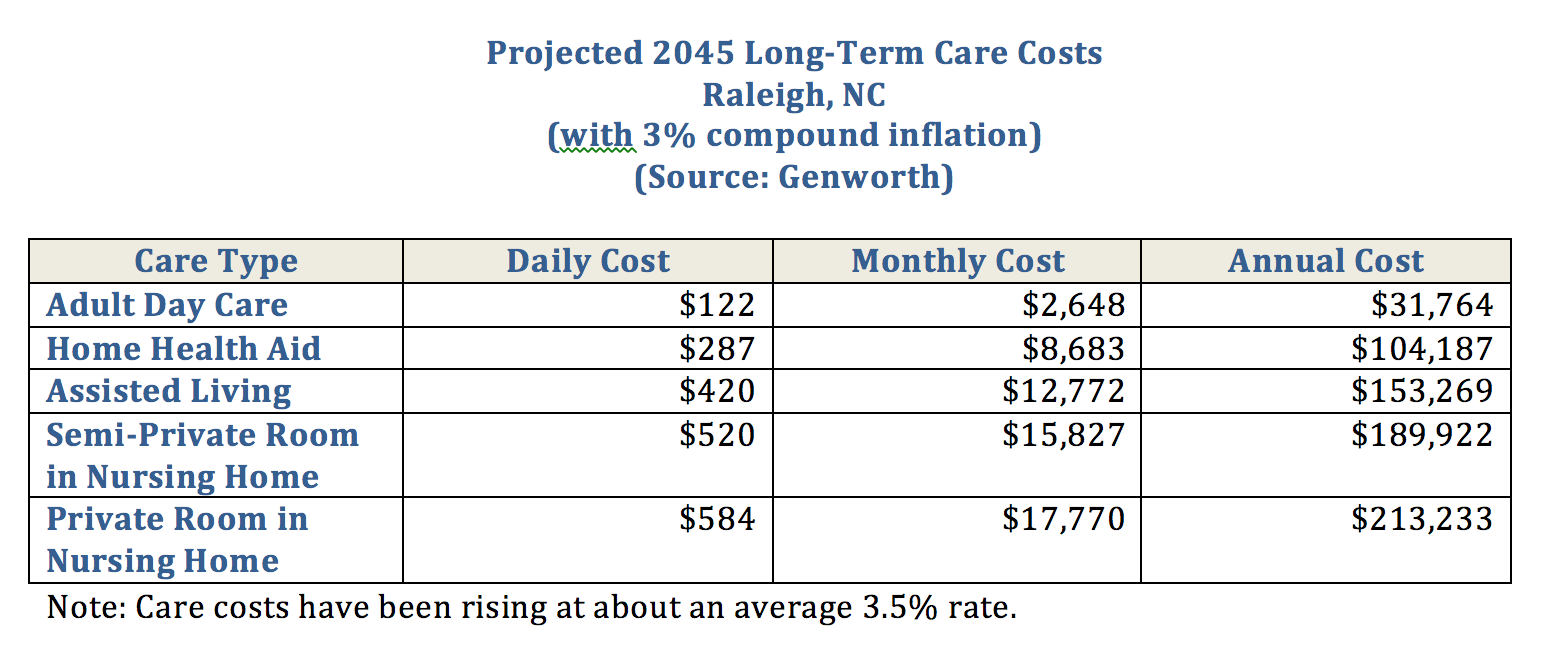

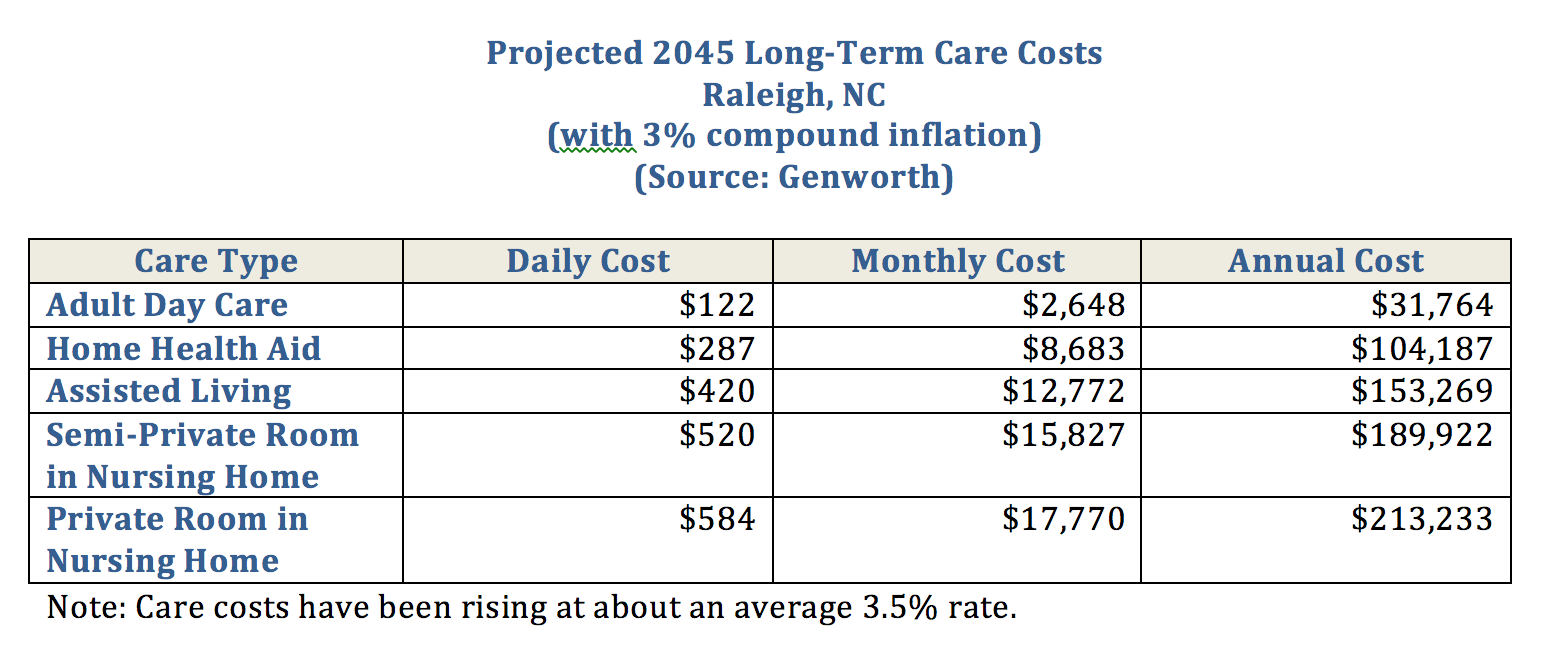

The AARP Long Term Care Insurance plan may not stack up to other options on the private market. Looking for does usaa offer long term care insurance. B Genworth Cost of Care Survey.

The Program RCW chapter 50B04 will be funded with a0058 058 percent payroll tax on all employee wages beginning January 1 2022. Its maximum daily benefits range from 50 to 400 per day and waiting periods between 90 and 180 days. A hybrid policy generally costs about 5 to 15 more than a standalone life insurance policy depending on the company you choose.

New York Lifes policies often limit Home Care where youre most likely to actually use your coverage to 80. There are also annuity-based policies where an existing insurance policy from a. A ASPE Lifetime Risk Study 2019.

Many hybrid long-term care insurance policies offer optional benefits. We are currently not offering new policies for Washington state residents. Long-Term Care Protection for When You Need It the Most.

USAA can help with long-term care needs. Premium rates are fixed you dont have to worry about future premium increases. A 65-year-old man has to pay 19399.

A large crowd of informed consumers should be more rational so the puzzle was. New York Life offers two types of long-term care insurance options. All other members call us at 800-531-1426 today.

Home care is most common. Americans bought 250000 hybrid LTC-life insurance policies last year according to Jesse Slome director of the AALTCI. These include a return of premium rider and an inflation rider that increases the benefit amount at the rate of inflation.

That data identified the long-term care insurance puzzle.

Hybrid Long Term Care Insurance Policies With Life Benefits Compare Long Term Care

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Hybrid Long Term Care Insurance Policies With Life Benefits Compare Long Term Care

Hybrid Long Term Care Insurance Policies With Life Benefits Compare Long Term Care

Long Term Care Insurance Information Usaa

Best Long Term Care Insurance In 2021 Retirement Living

Life Insurance With Long Term Care Rider Ltc Alternatives

Best Long Term Care Insurance In 2021 Retirement Living

Hybrid Long Term Care Insurance Policies With Life Benefits Compare Long Term Care

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

What Is Long Term Care Insurance And Do You Need It Clark Howard

Long Term Care Insurance Ltc Indemnity Vs Reimbursement

Usaa Long Term Care Insurance Cost And Review June 2021

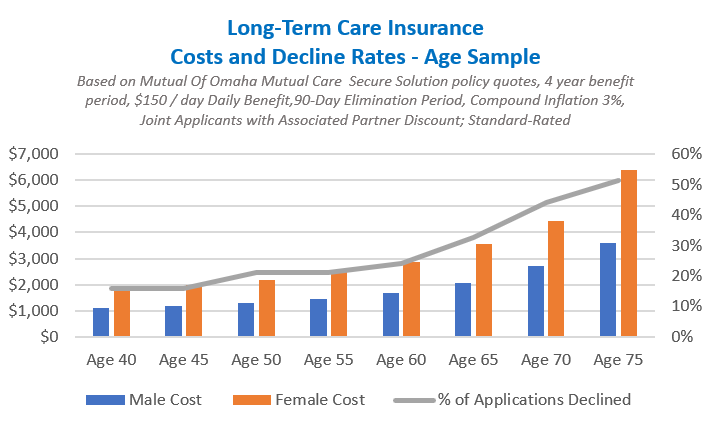

Mutual Of Omaha Long Term Care Insurance Compare Long Term Care

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

Insurance Healthcare For Sufficient Protection Smart Citisumer

Post a Comment for "Usaa Hybrid Long Term Care Insurance"