Is Life Insurance Necessary After Retirement

Every familys situation is different. If you do still need a life insurance policy after retirement remember that it probably doesnt need to be quite as large.

Do Single People Need Life Insurance It Depends Life Insurance Policy Life Insurance Life Insurance Premium

Also your new policy shouldnt have to have as long a term either.

Is life insurance necessary after retirement. Since life insurance helps replace lost income to your family when you die you may want to keep your policy if your spouse or other family members are relying on that income. According to financial expert Suze Orman it is ok to have a life insurance policy in place until you are 65 but after that you should be earning income from pensions and savings. Kids are expensive and raising them on one persons salary can be almost impossible.

Having life insurance after retiring is vital if your savings will not comfortably cover someone who is financially dependent upon you after you pass. Which type of insurance policy is best varies by personal preference and needs. Keeping Employer-Sponsored Life Insurance After Retirement Is Tricky The simple answer is yes you can keep the plan you acquired under your employer after youve retired.

Many believe that once you hit 65 and retire you no longer need life insurance. If your spouse relies on your Social Security or retirement benefits they may no longer be eligible to receive these funds if you pass awayThe death benefit provided by life insurance. Your next policy can likely be considerably smaller which is a good thing since your rates will be much higher.

That is why you want to identify all of the people depending on your income. However there are some stipulations. Having life insurance is almost always a necessity if youre a parent unless you have significant savings in the bank or your retirement accounts and even then its still a good idea.

After all the price of a 30 year policy at the age of 60 would be out of this world. Traditionally life insurance is thought to be needed when you have an income to protect when you have kids to support and you have a mortgageWhile having life insurance after 65 isnt for everyone there are very good reasons to consider it. If however you have very little income from your retirement job then theres probably no need to continue with the policy.

Its an important tool especially when you start looking at wealth transfer to the. If you do you get the payout. Some uses for life insurance after retirements are last expenses pay taxes at death and other business estate or legacy planning purposes.

Life insurance can be a good backup to replace this shortage of income just to be safe. However whole life insurance policies have much higher payouts than term insurance does. That said there are a few situations in which having life insurance.

Group life insurance is one of the most commonly offered benefits in an employer-sponsored benefits package. Life Insurance After Retirement The truth of the matter is that when you are in your 20s or 30s you barely think of what will happen in your old age. Life insurance can be used to replace all or a part of your pension benefits.

The term on whole life insurance is usually 100 years and the payout goes to your beneficiaries unless you live past the age of 100. Reasons Why Retirees Need Life Insurance Providing Financial Security for Your Family. This person can be a spouse partner special needs child sibling or other family members who will require more than your savings so they may live the life you want for them.

This is the time in life when people value traveling around the world and purchasing expensive things more than anything and pay little attention to buying life insurance. Its time to debunk this myth. If you decide that life insurance after retirement is the right option for you these policies might be the right fit.

That being said for most people insurance is needed after retirement - life insurance creates cash at death. As you pay off your debts and your children become independent you may end up only needing insurance that covers end of life. Life insurance can protect your family from the loss of your income when you die.

Whether life insurance makes sense or not for retirees depends on. Although the main purpose of life insurance is to replace lost income retirees may want to keep their coverage. Supplement your retirement income.

Not Only Do You Need The Necessary Protection But Even Your Properties And Related Assets Too Follow Us On I Retirement Planning Financial Planning Property

What Happens To Your Life Insurance When You Retire

When Should You Do Retirement Planning Retirement Planning Starting A New Job Retirement

Life Insurance Process Visual Ly Life Insurance Facts Life Insurance Marketing Life Insurance Sales

How Many People Buy Life Insurance Coverage In The U S And How Many Are Covered Life Insurance Quotes Term Life Insurance Quotes Homeowners Insurance Coverage

Get Your Best Life Insurance Policy With Lic Life Insurance Policy Life Insurance Agent Benefits Of Life Insurance

What Is Life Insurance Exact Definition Meaning Of Life Insurance

Section7702 Com Life Insurance Retirement Plan Home Do You Know What A 7702 Plan Is If Not Here Is All Whole Life Insurance Life Insurance Insurance Policy

What Happens To Your Life Insurance When You Retire

What Happens To Your Life Insurance When You Retire

What Is Life Insurance Exact Definition Meaning Of Life Insurance

Whole Life Insurance For Seniors Is So Famous But Why Whole Life Insurance For Seniors Life Insurance For Seniors Whole Life Insurance Life Insurance Cost

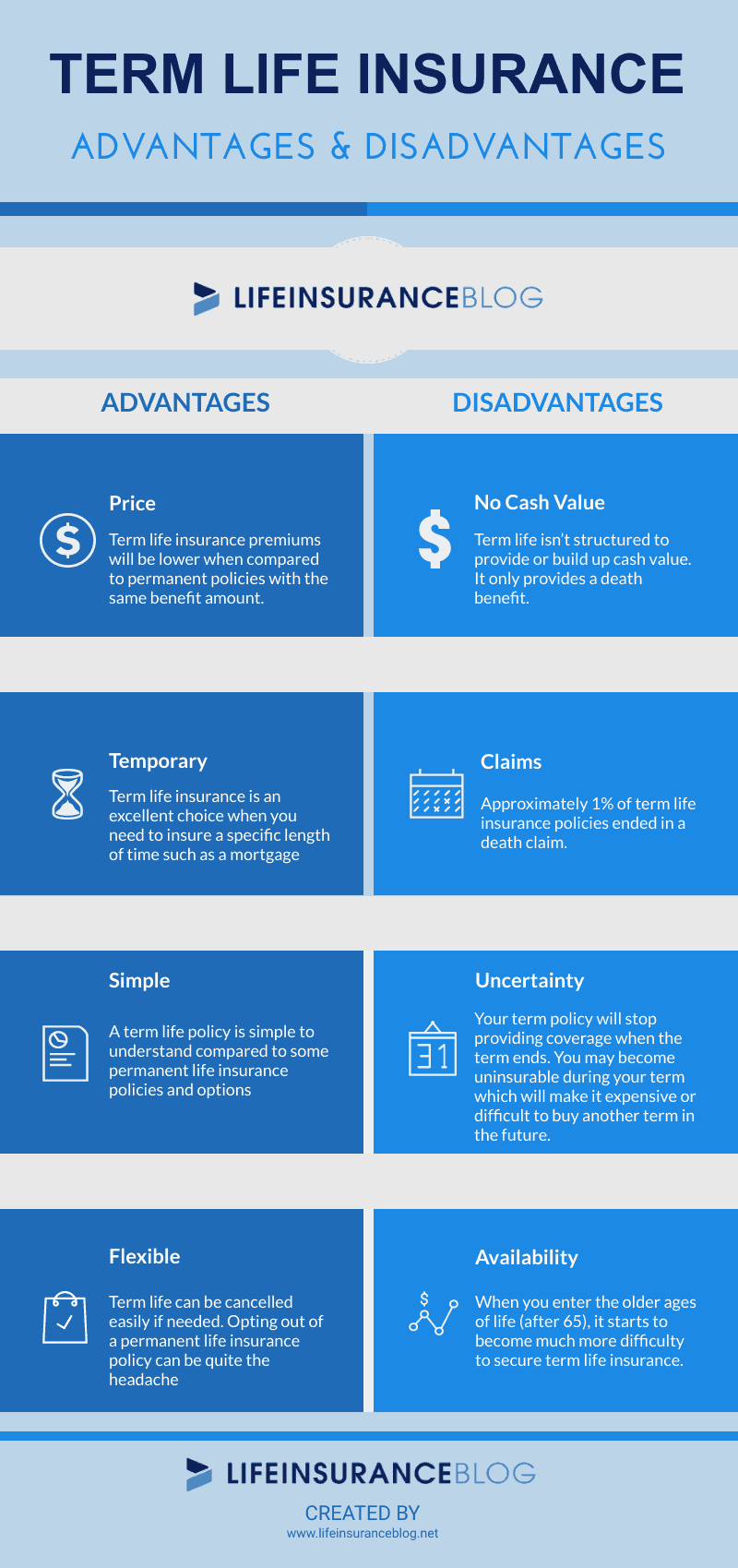

Advantages And Disadvantages Of Term Life Insurance Top 9 Facts

Life Insurance Icons Colored Life Insurance Corporation Life Insurance Companies Life Insurance Facts

Did You Know Each Person Should Be Fitted With An Insurance Solution Like A Tailor Fits Life Insurance Sales Life Insurance Marketing Life Insurance Facts

What Is Whole Life Insurance Important Whole Life Insurance Life Insurance Permanent Life Insurance

Presently Numerous Individuals Can State That Life Insurance Resembles Betting You Ar Life Insurance Marketing Ideas Life Insurance Facts Life Insurance Agent

Individual Life Insurance Vs Group Term Life Insurance Fbs Life Insurance Facts Term Life Life Insurance Types

Post a Comment for "Is Life Insurance Necessary After Retirement"