Does Paying Car Insurance Monthly Build Credit

Get a quick quote online today and take advantage of our no claims discounts. Building a history of timely payments is one of the best ways to improve your credit score.

Why Do You Need A Credit Card In 2020 Personal Finance Advice Credit Card Good Credit

But paying your auto insurance on time each month may not be enough to boost your credit score.

Does paying car insurance monthly build credit. Simply paying for car insurance cannot help you build credit. Free consultation from our experienced insurance advisors. Paying for car insurance with a credit card like paying any bill with a credit card has its pros and.

Paying certain bills on time can help you build credit. If Im late paying my car insurance will. There is one way you can use car insurance to build credit if youre clever.

There is no direct affect between car insurance and your credit paying your insurance bill late or not at all could lead to debt collection reports. You should never leave a balance on a credit card that you cannot afford to pay. Your auto insurance policy is not directly tied to your credit the same way as.

Jul 18 2016. There are things you can do such as charging your insurance to your credit card and paying it off monthly that will help. If you would like to build credit using car insurance you can pay it using a credit card and then pay that credit card bill each month.

Does Paying Insurance Build Credit. Free consultation from our experienced insurance advisors. However maintaining car insurance and paying your bill on time will not result in a significant impact on your credit score like making timely credit card payments.

Building a credit score is important especially to younger adults. Price within 30 seconds. But putting your bills and other monthly payments on a credit card can also be risky sometimes using a credit card can mean extra fees or charges and putting too many different payments on your credit card can lead to credit card debt if you arent able to fully pay off your balance each month.

However paying your insurance on time does help you avoid late fees and get into good habits that could later translate to helping you build credit. These payments will help to establish a credit rating and improve your credit score. Credit bureaus look at any new accounts loans and other aspects where you may have a payment history.

However you can still use your insurance premiums to build good credit. Annons Save money on your insurances. A car insurance policy paid monthly is a kind of instalment loan and these monthly payments show up on your credit report.

You arent exercising a kind of credit or loan so there is no reason to report the payments to credit bureaus. Therefore carriers do not report positive or negative information to the bureaus because there is no risk of loss. The short answer is no.

Annons Trust Islands car insurance to give you peace of mind with the coverage you need. Using Credit to Determine Rates Car insurance providers can have access to your credit report so they know if you make your credit card and loan payments on time. Like normal monthly bills paying for car insurance does not improve your credit.

Annons Save money on your insurances. Insplanet assists you in choosing the right insurance. Get a quick quote online today and take advantage of our no claims discounts.

Paying insurance premiums does not build your credit history. Debt collection reports do appear on your credit report often for 7-10 years and can be read by future lenders. The answer is no.

1 Does paying your car insurance build credit. You are correct that in the majority of states credit has an impact on your overall rate. Insurance companies bill in advance of providing the coverage.

Annons Trust Islands car insurance to give you peace of mind with the coverage you need. However if you fail to pay your car insurance bill long enough that bill could be turned over to a collections agency and listed as a delinquent payment to the credit bureaus hurting your credit. If you pay in full and on time every month this can build up your credit score over time.

Insplanet assists you in choosing the right insurance. However if you choose to pay your monthly car insurance premiums using your credit card and you make your payments on time it may improve your credit score. Unfortunately making auto insurance payments or any insurance payments is not a method you can use to build your credit score.

Whether it is your car insurance or life insurance paying their premiums on time wont count in your credit score. If you are late or miss a payment this will bring down your credit rating. You can get a credit-score boost from your car insurance if you charge it to your credit card and pay it off monthly.

Price within 30 seconds. Your insurer could also cancel your policy. You can still use car insurance to help you build credit by charging it to your credit card and paying it off in full every month says personal finance coach Whitney Hansen.

Credits impact on car insurance. But when it comes to car insurance paying your premiums has little to do with improving your credit score. If youre wondering why your credit score seems low check your credit report for the details.

Myth Vs Fact Carrying Balances On Credit Cards Credit Repair Build Credit Credit Repair Services

Best Car Insurance Companies Of August 2021 Forbes Advisor

Cheap Car Insurance How To Get Affordable Auto Insurance Rates Cheap Car Insurance Car Insurance Insurance

Pin On Simple Steps To Frugal Living

How To Build Credit The Simple Dollar Build Credit Paying Off Credit Cards Credit Score

Insurance Journal Entry For Different Types Of Insurance

Ask Me How You Can Obtain A Credit Score Of 850 Make This Year Your Year Of Good Credit You Don T Have To Good Credit Bad Credit Improve Your Credit Score

Credit My Rent Build Credit With Your Rent Do You Rent Your Current Home Are You Living In An Apartment C Credit Repair Services Build Credit Credit Quotes

Annual Vs Monthly Car Insurance Moneysupermarket

Customizing Monthly Car Insurance No Deposit For Optimum Benefits Car Insurance Insurance Car

No Credit Car Financing Dealership Offer Easily Manageable And Sustainable Monthly Car Payment Car Finance Credit Cars Car Payment

Facing High Payment Issues With Auto Insurance Let Us Help You Freecarinsurancequote Help You Find Low Deposit Car Insurance Insurance Getting Car Insurance

Tips For Car Insurance Autoinsurance Life Insurance Humor Life Insurance Agent Car Insurance

How Credit Scores Affect Car Insurance Nationwide

Cheap No Deposit Monthly Car Insurance Life Insurance Quotes Home Insurance Quotes Insurance Quotes

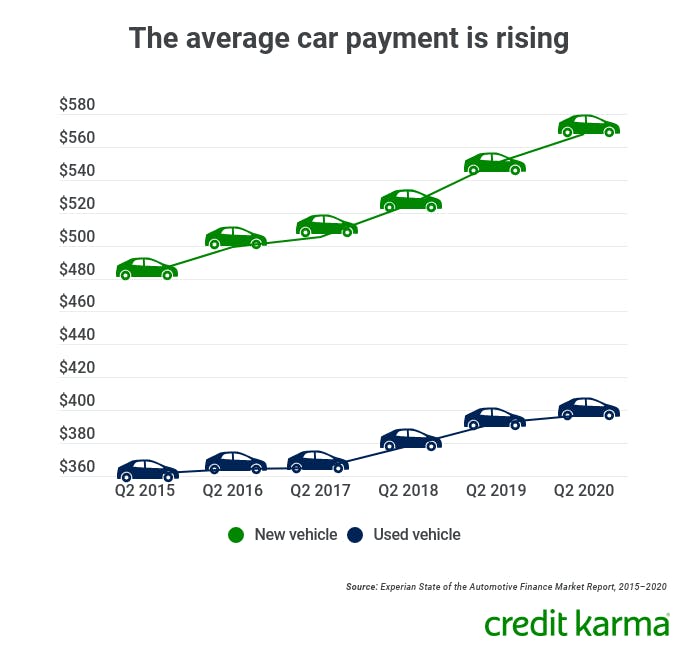

What Is The Average Car Payment Credit Karma

Credit Restoration Iw Credit Repair United States Credit Quotes Bad Credit Quotes Credit Repair

Root Car Insurance Review Good Drivers Can Save Big Money Car Insurance Finance Family Money

Becoming Her On Instagram Cash Is King And Credit Is Power You Could Be Leaving So Much On The Table Finan Good Credit Credit Repair Services Repair Quote

Post a Comment for "Does Paying Car Insurance Monthly Build Credit"