Do Car Insurance Companies Go After Uninsured Drivers

Each car insurance policy pays out differently so lets take a look at how each type of coverage works. Yes uninsured or underinsured motorist coverage covers accidents caused by another driver who drives away from the accident scene.

Auto Insurance Facts And Figures Infographic Car Insurance Car Insurance Facts Insurance

How to make a claim after being hit by an uninsured driver.

Do car insurance companies go after uninsured drivers. The car insurance company turns uninsured motorist claims over to their subrogation department. Others make a claim after colliding with another driver who doesnt have car insurance. For uninsured drivers the process can.

The coverage you choose will affect how your car insurance works. Several attempts are made by this department to make payment arrangements with the uninsured driver to pay for the damages over time. Youll also need to tell your car insurance provider about the accident.

Generally insurance companies will not raise rates after an uninsured motorist claim. Youre given a report to fill out that validates the authenticity of your accident. Insurance coverage for car accidents.

The California Department of Motor Vehicles investigates the insurance for all drivers involved in accidents regardless of fault. The uninsured driver may still have to pay penalties for driving without car insurance. The cost of compensating the victims of uninsured drivers is added on to your car insurance premiums making them more expensive than they should be.

So if you have car insurance and you hit an uninsured driver your insurance company will cover you. Making your insurance claim is quickly done with these simple steps. Your car is likely to be seized too.

Insurance companies usually wont provide insurance cover in circumstances where the driver was either unlicensed or had a suspended licence. So whether the driver has insurance or not youll file the claim with your insurance company. Second if your Uninsured Motorist insurer pays you for an at fault driver who was uninsured it will seek to recover all of the money paid to you directly from the uninsured driver.

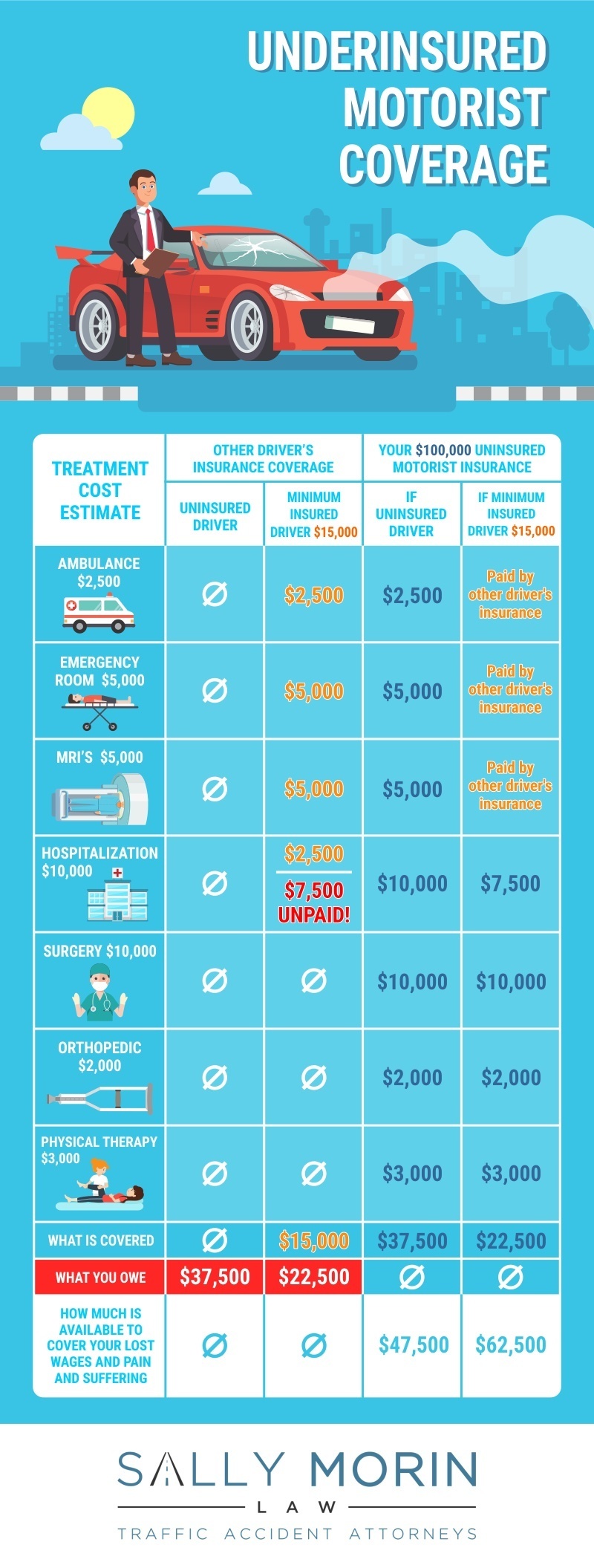

Uninsured UM or underinsured UIM motorist insurance coverage. Uninsured or underinsured motorist coverage pays for damages caused by drivers who dont have car insurance or do not have enough. There will be pretrial investigation disclosure of your medical records and depositions of witnesses.

This also can include a driver hitting you as a pedestrian and driving away. The uninsured driver may offer you money to cover your cars damages. Second if your Uninsured Motorist insurer pays you for an at fault driver who was uninsured it will seek to recover all of the money paid to you directly from the uninsured driver.

What happens if an uninsured. This is because both employer and employee can be prosecuted if your insurance cover is not up-to-date. Uninsured and underinsured motorist coverages are policy add-ons that you can choose when you purchase insurance.

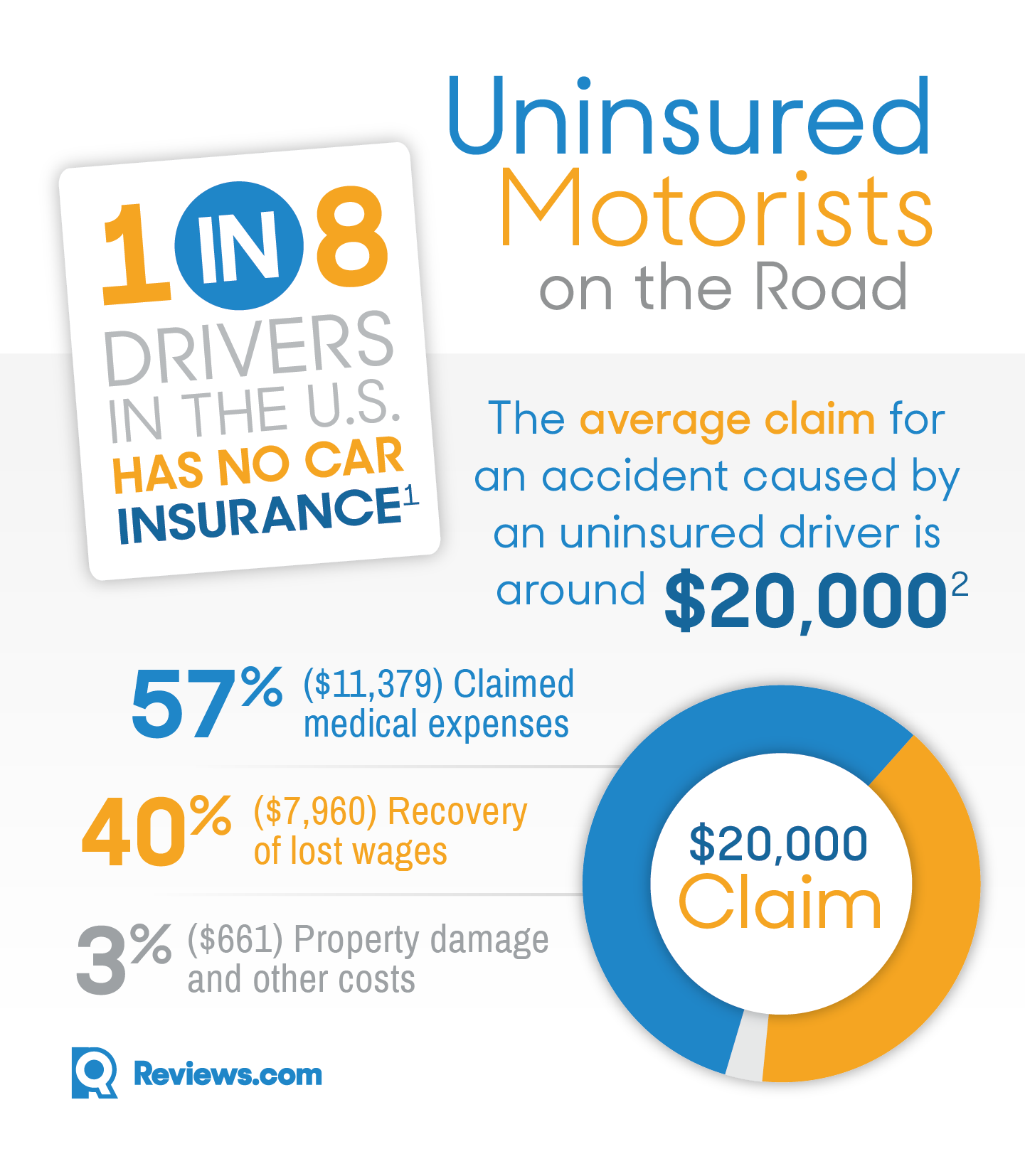

In line with national statistics 13 of the demands we launch to recover fleet damages are targeted at the uninsured. In general an uninsured or underinsured driver claim progresses in the same way as a regular car insurance claim except that the claim is against your own insurance company. You never know when or if youll have a run-in with an uninsured driver but it could happen to anyone.

For all of our recovery demands it takes an average of less than 60 days for us to get recovered funds into our customers hands. If you drive without car insurance you face a fixed penalty notice of 300 fine and up to six penalty points on your licence. It is important to remember in this instance your insurance company can and will fight the claim against you.

If the insurance company is unable to obtain a commitment to make payments some companies will then turn the uninsured driver over to a. Do insurance companies go after uninsured drivers. Do Insurance Companies Go After Uninsured Drivers.

Insurance that covers liability protects you from. Your uninsured driver coverage UM allows you to make a claim up to your coverage limit against your own insurer. Call the police and report your accident.

Failure to do so could invalidate your policy. If the other driver is uninsured or refuses to give you their details you must notify the police even if the damage is minor. If you live in a no-fault state then getting into a collision with an uninsured driver doesnt.

Most states are tort states meaning that whoever is responsible for the car accident is liable for the damages. The Best Coverage for Accidents With Uninsured Drivers. According to one of The Barnes Firms best car accident lawyers in Los Angeles insurance companies and ot.

This means any liability will need to be paid for by the unlicensed driver themselves. If youve included uninsured or underinsured motorist coverage your insurance will pay the claim after a collision with an uninsured driver. In 2015 CEI collected on behalf of our fleet customers almost 1 million from at-fault drivers who didnt have or claimed not to have insurance.

Do car insurance companies go after uninsured drivers. Insurance Premiums May Rise Slightly After an Uninsured Motorist Claim Some drivers make an uninsured motorist claim after a hit and run. The good news is theres a way to be proactive about your protection in the event you were to be hit by someone without auto insurance.

Refusing to give insurance information is as much a criminal offence as driving uninsured. The California Department of Motor Vehicles investigates the insurance for all drivers involved in accidents regardless of fault. Most insurance providers have a 247 emergency claims line so you can.

According to a study 13 of all people who drive as part of their job are uninsured Source. There are two forms of auto insurance that might help you cover your financial burdens. Keith Michaels Plc So whether youre the registered owner of the vehicle or your employee is it is always worth ensuring it is covered before anyone drives it.

In either case youll need proof of damage or witnesses to corroborate your story to your insurance company. If so decline the offer as accepting money for the damages affects your insurance.

7 Types Of Car Insurance You Should Consider Infographic Auto Insurance Quotes Car Insurance Car Insurance Tips

What Happens When You Re Hit By An Uninsured Driver Car Insurance Car Insurance Tips Car Insurance Online

Cheap Insurance Quotes For Lexus Lx 570 2016 Compare Quotes Insurance Quotes Cheap Car Insurance

How Much Uninsured Motorist Insurance Should I Get

Why All Drivers Need Uninsured Underinsured Motorist Coverage Reviews Com

What Is Uninsured Automobile Insurance Mitchell Whale Ltd

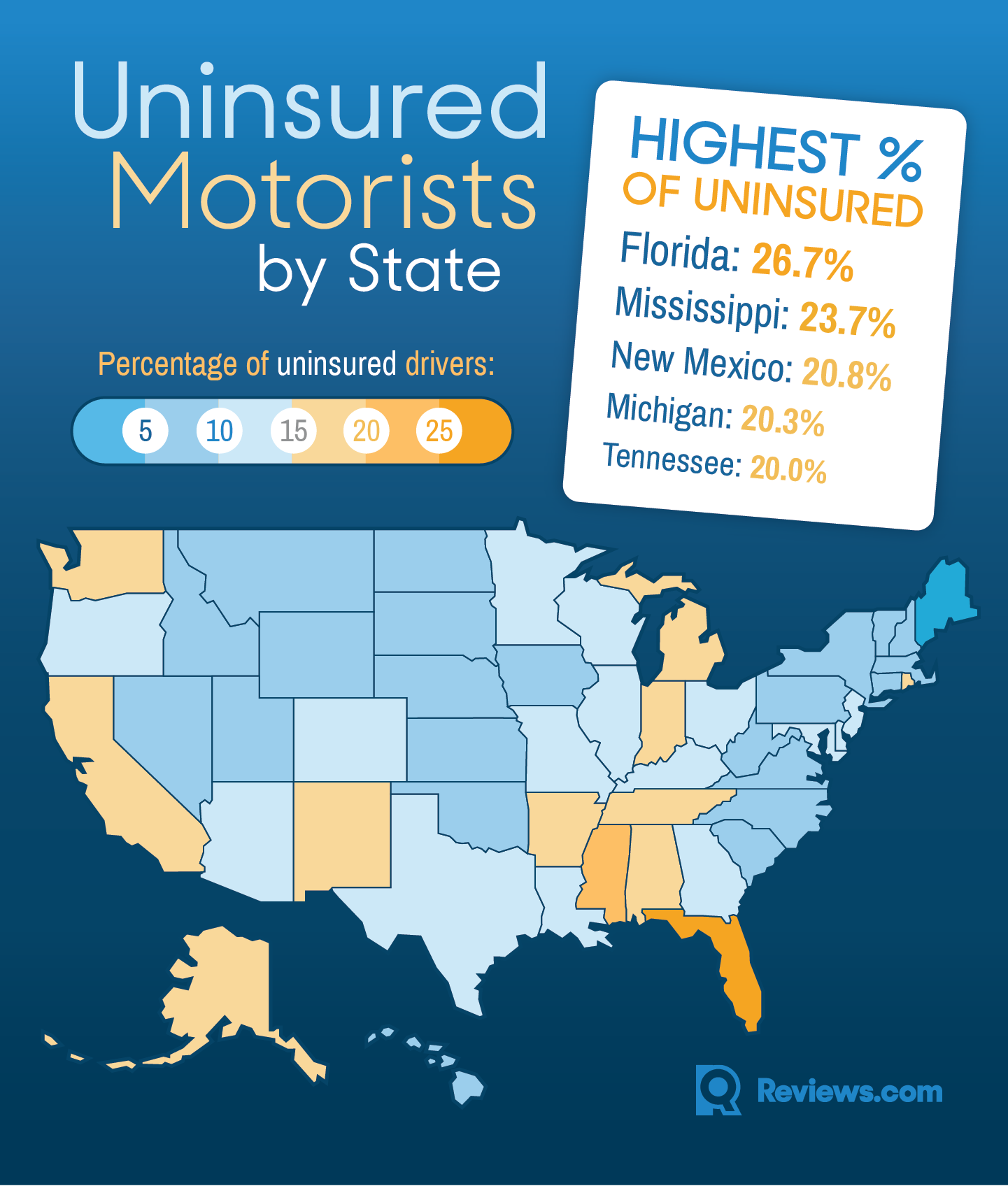

In 5 States 20 Or More Of Drivers Have No Insurance Countrywide Average Increases

Ask An Expert Can I Get Car Insurance Protection Against Uninsured Drivers Which News

Pin On California Car Insurance Companies

Why All Drivers Need Uninsured Underinsured Motorist Coverage Reviews Com

What Is Enhanced Uninsured Motorist Insurance Coverage Insurance Coverage Uninsured Motorist

Car Insurance Quotes Online South Africa Car Saab Car Insurance Online Home Insurance Quotes Insurance Quotes Auto Insurance Quotes

Why Buy Uninsured Motorist Coverage

How Much Will Auto Insurance Increase After Accident Di 2021

Peer To Peer P2p Car Sharing Risks Everquote Com Car Sharing Car Insurance Car

Saudi Arabia Will Permit Ladies To Drive Kingdom Media Reported Overdue Tuesday Car Lease Car Insurance Rates Car Buying Tips

Know Difference Among Underinsured And Uninsured Motorist Coverage Uim Um Motorist Uninsured Car Insurance

Car Insurance Terms Glossary Life Insurance Facts Car Insurance Getting Car Insurance

Post a Comment for "Do Car Insurance Companies Go After Uninsured Drivers"