When Must Insurable Interest Exist For A Life Insurance Contract

To confirm that an insurable interest is present a life insurance company will usually talk to the policy owner beneficiary and insured. How do you prove insurable interest.

As It Pertains To Life Insurance Which Of The Chegg Com

When the insured dies d.

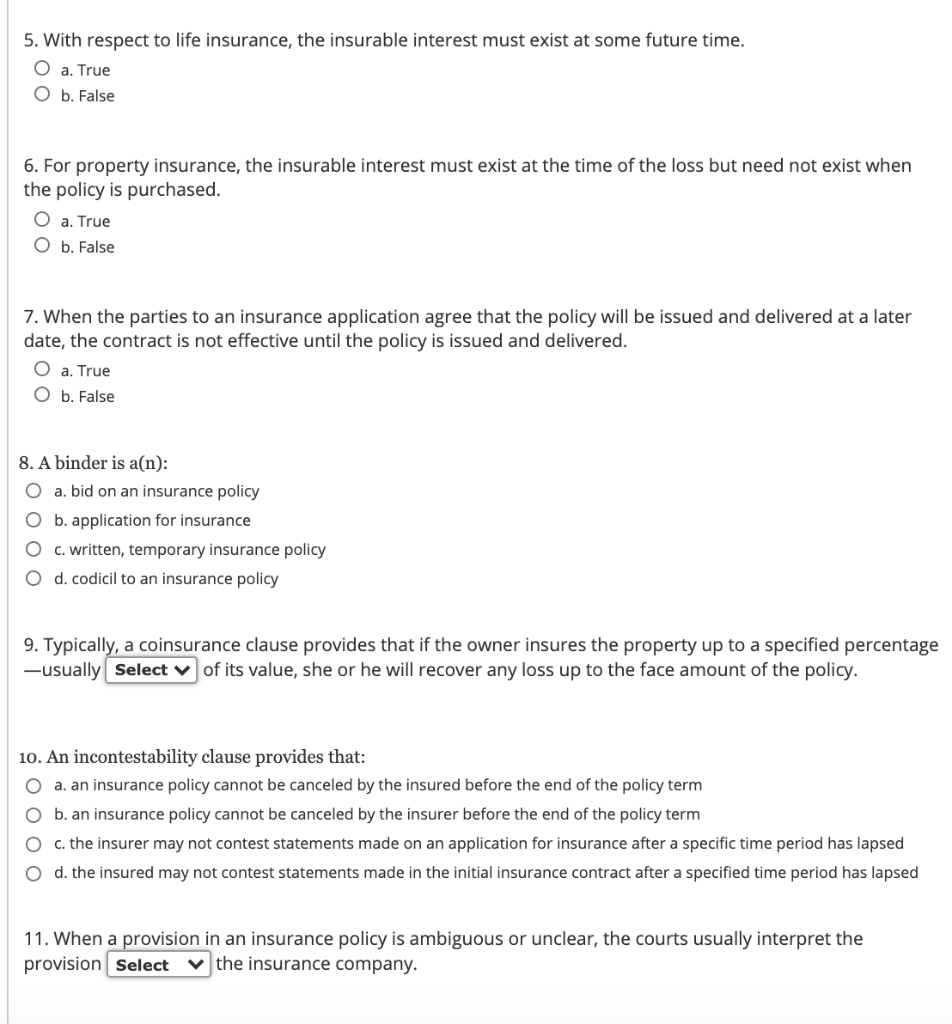

When must insurable interest exist for a life insurance contract. Incase of fire insurance insurable interest must exist both at the time of the contract and at the time of loss. In other words if a persons death would cause you a significant financial harship its an insurable interest. So unlike property insurance an insurable interest must exist at the time of the purchase of the life insurance not afterward or even when death occurs as long the premiums are paid.

Each takes out a 500000 life insurance policy on the other naming himself as primary beneficiary. Where an insurance contract requires the existence of an insurable interest for effecting the policy such interest is known as Contractual insurable interest while an insurable interest mandated by a particular statute dealing on insurance is known as Contractual insurable interest. This characteristic of life insurance is what allowed the existence of viatical settlements in the late 1980s and 90s in which people with AIDS sold their life insurance policies to investors for.

Inception of the contract b. Throughout the entire length of the contract c. This is different from a policy.

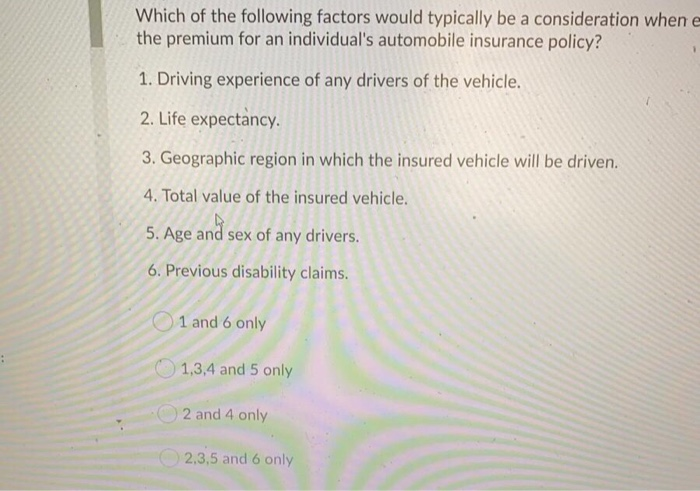

Insurable interest for life insurance is required when the policy is issued but not when the insured person dies. For a life insurance contract to be valid the insurable interest must exist at the time the policy is purchased. It is noteworthy that neither the British Life Assurance Act 1774 nor the Insurance Act 1938 of India defines the term insurable interest.

Insurable interest underpins all insurance coverage but its critical with respect to life insurance. They will also make sure the owner has an insurable interest in. Insurable interest discourages people from betting on the life of a person or object and trying to profit from their or its untimely demise.

See full answer below. The 1774 Life Assurance Act imposes a requirement for the policyholder to show an insurable interest in the life insured at the time the contract is taken out. The requirement for an insurable.

Its a good idea to get the spouses OK and go through the normal life insurance process of having the spouse get a policy and name you as a beneficiary. If you have insurable interest you can take out a life insurance policy on your spouse. In life insurance insurable interest must exist between the policyowner and the insured at the time of the application.

A contract under which one insurance company the reinsurer. During the contestable period. This interest can be created in the following circumstances.

In England and Wales this only covers the policyholders own life or his spouse not other. The underwriters will determine if your named beneficiary has an insurable interest in your life. Where the policyholder has a relationship of natural affection with the life insured.

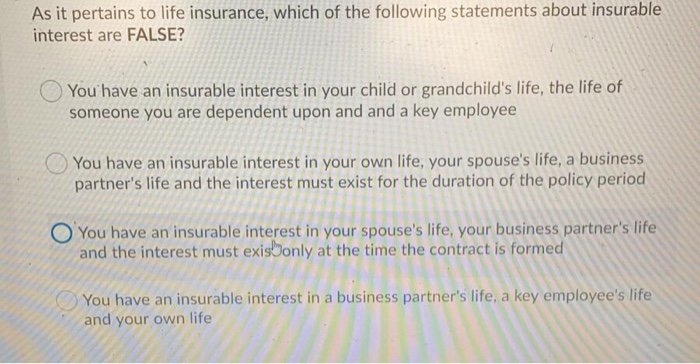

In the case of a life insurance policy the owner of the policy must always have an insurable interest in the life of the insured. 1Survivor Protection 2Estate Creation. However an insurable interest no longer exists.

What are some common personal uses of life insurance. Also if the owner of the policy is not the beneficiary then the beneficiary named in the contract would also need an insurable interest in the insured person. Although E was married with three children at the time of death the primary beneficiary is still F.

A person or entity has an insurable interest in an item event or action when the damage or loss of the object would cause a financial loss or other hardships. E and F eventually terminate their business and four months later E dies. When must insurable interest exist for a life insurance contract to be valid.

In that context insurable interest exists when you are financially benefiting from the insureds ongoing health and safety. Said another way you are at risk of financial loss if the insured were to pass away. One of the key principles of an insurance contract is Insurable Interest which must be present in all contract of insurance otherwise it becomes a wager rendering it.

In order to purchase a policy insurable interest must exist. A contract without insurable interest is null and void for all purposes though in practice void contracts are often performed as if they had full legal effect. To have an insurable interest a.

In Life insurance policies insurable interest must exist at the issue of the policy.

How Life Insurance Works Your Guide To Understanding Life Insurance

As It Pertains To Life Insurance Which Of The Chegg Com

Banking Insurance Insurance Ins Uranc E Is A

What Is An Insurable Interest In Life Insurance Definition Faqs

As It Pertains To Life Insurance Which Of The Chegg Com

Https Heinonline Org Hol Cgi Bin Get Pdf Cgi Handle Hein Journals Safrmerlj18 Section 29

Chapter 9 Fundamental Legal Principles Agenda Principle Of

/WhenMustInsurableInterestExistinaLifeInsurancePolicyMay262021-65b9b5a62d38425fbdaaa3a53f11397d.jpg)

When Must Insurable Interest Exist In A Life Insurance Policy

History Of Life Insurance Continuing Education Insurance School Of

Insurance Lingo Your Quick Reference Guide Infographic Life And Health Insurance Insurance Marketing Insurance Humor

Principles Of Valid Contract Special Principles Of Life Insurance

Pdf Chapter 1 Insurable Interest Hossain Fahad Academia Edu

Life Insurance Pdf Life Annuity Annuity European

Powerpoint Basic Principles Of Life Insurance

What Is Insurable Interest Definitions Permanent Life Insurance Universal Life Insurance

What Is Insurable Interest In Life Insurance

Lecture No 11 Insurance Company Operations Objectives Rating

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Post a Comment for "When Must Insurable Interest Exist For A Life Insurance Contract"