What Is Twisting And Churning In Insurance

Churning is excessive trading by a broker in a clients account in order to generate commissions. Churning is an unethical and illegal practice that violates SEC rules 15c1-7 and securities laws.

Http Media Andybeverly Com Pc Agents 2 20 Basicdata Pdf

Churning is in effect twisting of policies by an existing insurer.

What is twisting and churning in insurance. Some have accused me of twisting or churning policies. What is insurance twisting. Twisting the more general term applies to the sale of other products as well such as insurance policies.

It is also a term for a particular form of misconduct performed by insurance agents where they. Replacement Twisting and Churning. An attempt to convince an individual to sell one product and purchase another product primarily so the salesperson can earn additional commissions.

Twisting or churning as it is more recently called is the act of an insured under the influence of a financial adviser cancelling or allowing to lapse an in-force insurance policy with a view to then immediately or soon after replacing it with another policy that provides equivalent or. Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations coverage with Carrier A is replaced with coverage from Carrier B. Agents should be aware that replacement of coverage can in some cases be inappropriate and therefore unethical.

It is however a practice that can lead to ethical lapses. Replacement is defined as changes in existing coverage usually with coverage from one insurer being replaced with coverage from another. Insuranceopedia Explains Twisting.

In simple terms twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations coverage with Carrier A is replaced with coverage from Carrier B. Some agents earn commissions on their policy sales and could be motivated to increase their commissions by selling someone a policy that they dont need. Insurance laws differentiate between churning and twisting of life insurance policies.

What is life insurance churning. Also known as twisting this practice is illegal in most states and is also against most insurance company policies. I have had several conversations with different insurance producers on my strategies for selling health insurance.

If a customer is enticed into replacing an existing policy with a policy from the same. The act of twisting when life insurance is being sold is illegal in most states. Insurance twisting is when an agent convinces a policyholder to drop their existing policy and take out a new policy that isnt in their best interests.

What is the difference between twisting and churning. Twisting the act of inducing or attempting to induce a policy owner to drop an existing life insurance policy and to take another policy that is substantially the same kind by using misrepresentations or incomplete comparisons of the advantages and disadvantages of the two policies. Those who are not associated with the industry may wonder what twisting in insurance may include.

Run dont walk if an agent promises you a new. Twisting insurance is a term that people dont frequently use so fraud is very prevalent these days. I will explain how I sell most of my clients and you can decide on your own what you think twisting or churning is.

Churning is the same type of scam except if an insurance company churns a policy. Discover more about the practice of churning here. Twisting occurs when an insurance agent replaces an existing life policy with a new one using misleading tactics.

Whereas churning tricks a policyholder to drain policy funds for a new policy with the same insurer twisting is where a policy holder is tricked into draining funds from their life insurance policy for a policy with another insurer. Insuranceopedia Explains Churning. Churning is another sales practice in which an existing in-force life insurance policy is replaced for the purpose of earning additional first-year commissions.

Twisting hurts clients financially but its a sweet deal for the agent who pulls it off. Insurance companies use churning to describe the rate at which their customers leave due to reasons like selling assets going elsewhere for more competitive rates or voluntary churn where insurers choose to not renew clients with poor loss ratios. Defining Insurance Twisting Churning and Replacing Twisting an insurance policy means to replace an existing policy with one from another company a policy that is worse than the original.

Churning is in effect twisting of policies by the existing insurer coverage with Carrier A is replaced with coverage from Carrier A. First lets take a look at life insurance long-term benefits which may help you understand that twisting. Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations coverage with Carrier A is replaced with coverage from Carrier B.

In the brokerage business twisting is usually called churning. Twisting is almost the same thing but for a little difference.

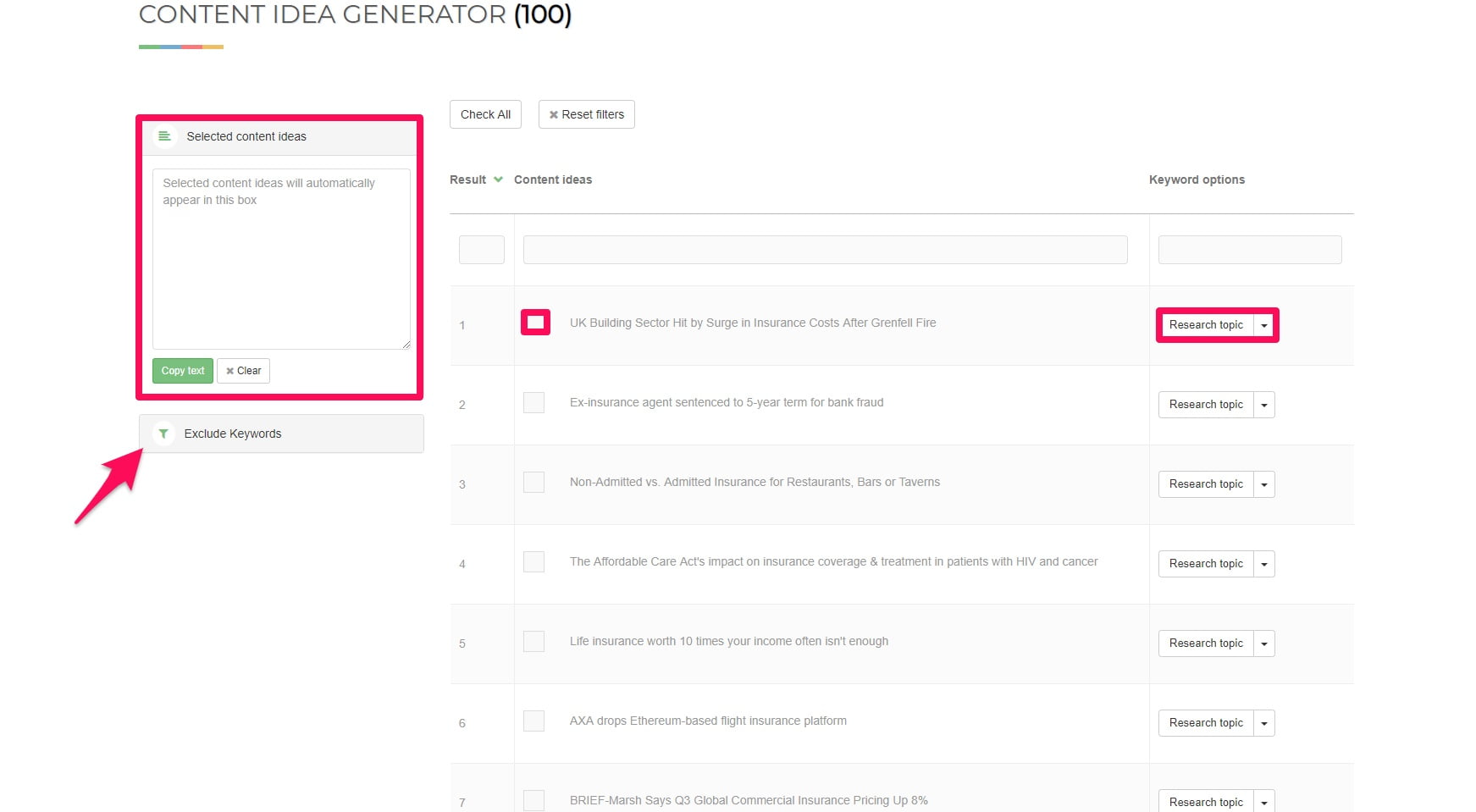

How To Generate Insurance Leads A Master Guide

Http Www Casact Org Community Affiliates Camar Erm Risk Controlling Pdf

How To Generate Insurance Leads A Master Guide

Do Life Insurance Policies Have The Best Interest Of Consumers

Pro Football Player Uses Mouth Guards For Protection Then Cleans Them For Profit

Coffee Crunch Ice Cream No Churn Dessert Chocolate Yummy Cookies Ice Cream Desserts

Insurance Florida Statutes Rules Regulations Common To All Lines Flashcards Quizlet

How To Generate Insurance Leads A Master Guide

Do Life Insurance Policies Have The Best Interest Of Consumers

Lieutenant Columbo S Lessons For Detecting Insurance Fraud

Lieutenant Columbo S Lessons For Detecting Insurance Fraud

Diy Beaded Necklaces Bracelets And Jewelry Interweave Wire Jewelry Twist Jewelry Wire Jewelry Tutorial

How To Generate Insurance Leads A Master Guide

2 15 Chapters 1 3 Flashcards Quizlet

The Heart Shape Slime Ice Cream Desserts Heart Shapes

How Do I Know If My Account Was Churned Melanie S Cherdack

How To Generate Insurance Leads A Master Guide

Do Life Insurance Policies Have The Best Interest Of Consumers

Post a Comment for "What Is Twisting And Churning In Insurance"