Do Insurance Companies Go After Underinsured Drivers

The Best Coverage for Accidents With Uninsured Drivers. Does AAA offer umbrella policies.

Chicago Uninsured Motorist Um Lawyer Rosenfeld Injury Lawyers

Optional auto insurance coverage in Ohio includes uninsured and underinsured motorist policies.

Do insurance companies go after underinsured drivers. If a driver with low coverage limits hits you and causes a serious injury it is possible that the available insurance benefit wont. The final option for pursuing a settlement that exceeds policy limits is if the insurance company has acted negligently towards the at-fault driver leaving them exposed to a large judgment. The car insurance company turns uninsured motorist claims over to their subrogation department.

Insurers do not want people purchasing bare bones coverage for their own liability and loading up on uninsuredunderinsured motorist coverage. Several attempts are made by this department to make payment arrangements with the uninsured driver to pay for the damages over time. Typically uninsuredunderinsured motorist coverage is inexpensive.

Most drivers know why they must purchase auto insurance. What Happens if You Hit an Uninsured Driver. When it comes to uninsured motorist claims the cheapest insurance companies are Progressive Allstate Farmers.

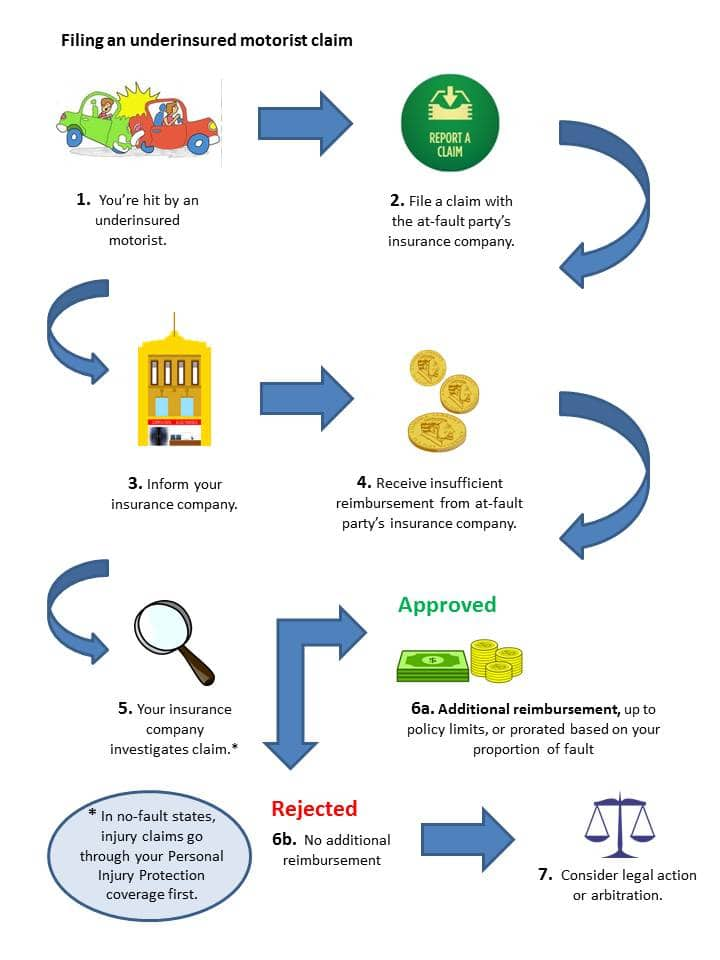

In that situation you would make a claim against your own insurance company up to the limit of your underinsured motorist coverage but only if your underinsured driver coverage is greater than the negligent drivers. This is commonly called the Stowers doctrine in Texas after the landmark Texas court case that established the principle. In Ohio uninsured and.

They offer the least compensation for pain and suffering. Your insurance company may even defend the uninsured drivers position to limit the amount of money that it will pay to you. However insurance companies have a legal duty to handle insurance claims fairly and in good faith.

Unfortunately when a driver is uninsured even a settlement offer for the maximum amount of the policy will be inadequate to compensate the victim or victims of an accident. Underinsured motorist coverage steps in when the at-fault drivers policy limit is less than your damages. Your Maryland car accident lawyer will be better able to represent you if you ensure your policy is adequate before you need to draw on it.

This means that after an Alabama car accident youll file a claim with the at-fault drivers insurance company. However some drivers may not have enough insurance coverage for all the property damage and injuries they caused. When youre struck by an uninsured driver you will know almost immediately that they dont have insurance which means you can go ahead and file your claim.

In the unlikely event youre involved in an auto accident with an uninsured or underinsured driver. Some drivers also choose to drive illegally without auto insurance. With an underinsured driver on the other hand you may not know theyre underinsured until a good deal of time has passed from when your accident occurred possibly limiting your ability to file a successful claim.

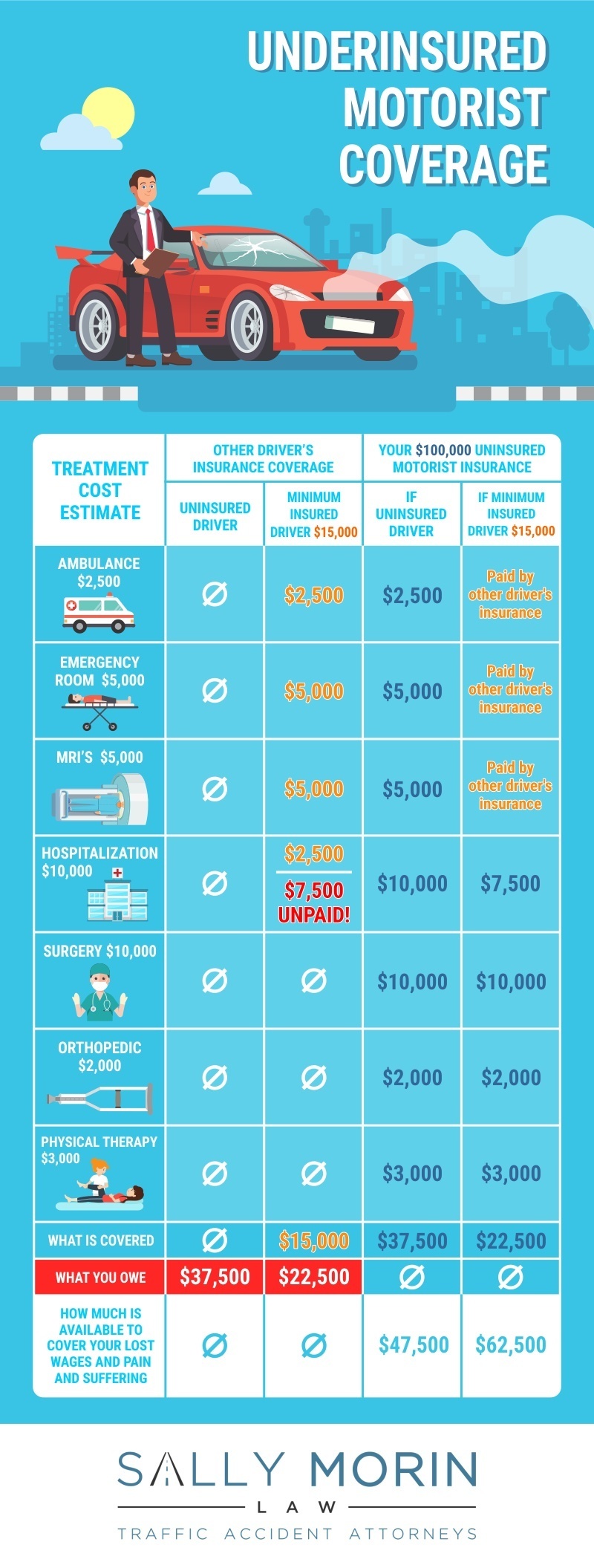

You can see that the minimum auto liability coverage required in Virginia will not go far in a serious car accident. Why UMUIM Coverage is So Important. If you dont have uninsured motorist coverage on your own insurance policy you cannot make a claim or recover damages against an uninsured driver.

They pay above average but will still fight you hard. This is why insurance companies offer uninsuredunderinsured motorist coverage UMUIM and why Virginia requires insurers to offer UM coverage equal to liability coverage sold. Underinsured drivers will often purchase only the minimum amount of insurance required by law which in some states isnt much.

If youve included uninsured or underinsured motorist coverage your insurance will pay the claim after a collision with an uninsured driver. UM coverage provides payments. If the insurance company is unable to obtain a commitment to make payments some companies will then turn the uninsured driver over to a.

If your insurance adjuster violates that duty you may have grounds for a bad faith claim against the insurance company. When an uninsured driver is at fault in a car accident the insureds insurance companies are usually responsible for the damages. In general an uninsured or underinsured driver claim progresses in the same way as a regular car insurance claim except that the claim is against your own insurance company.

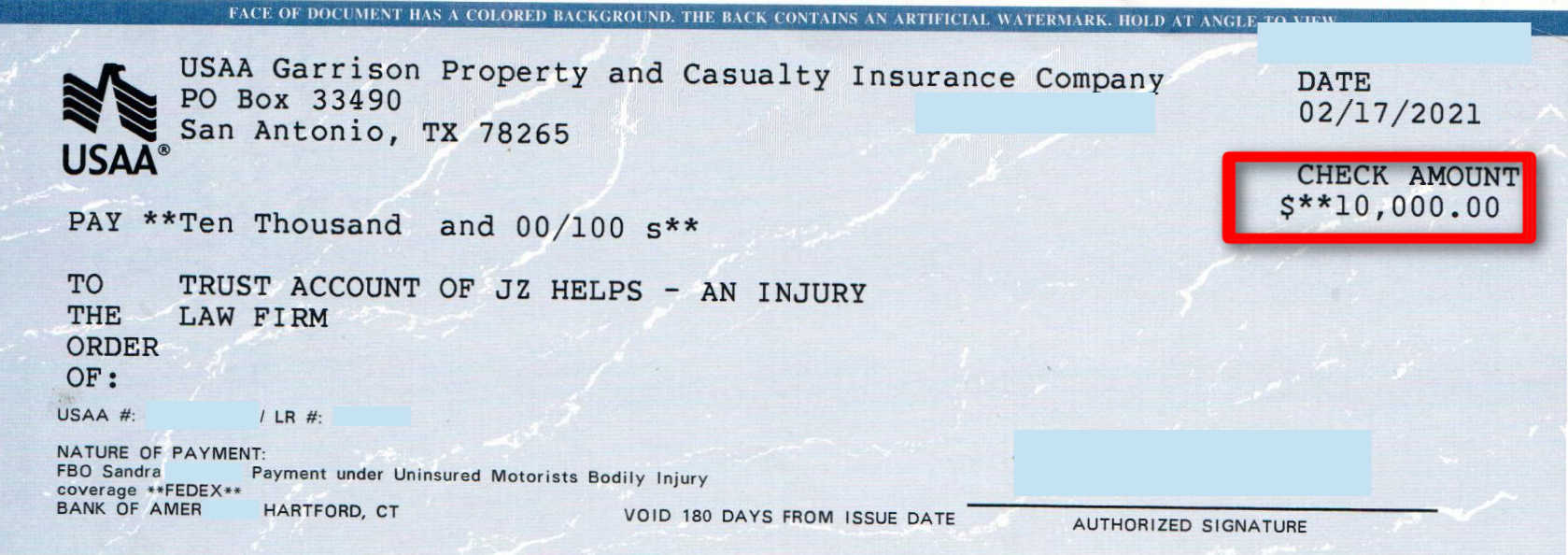

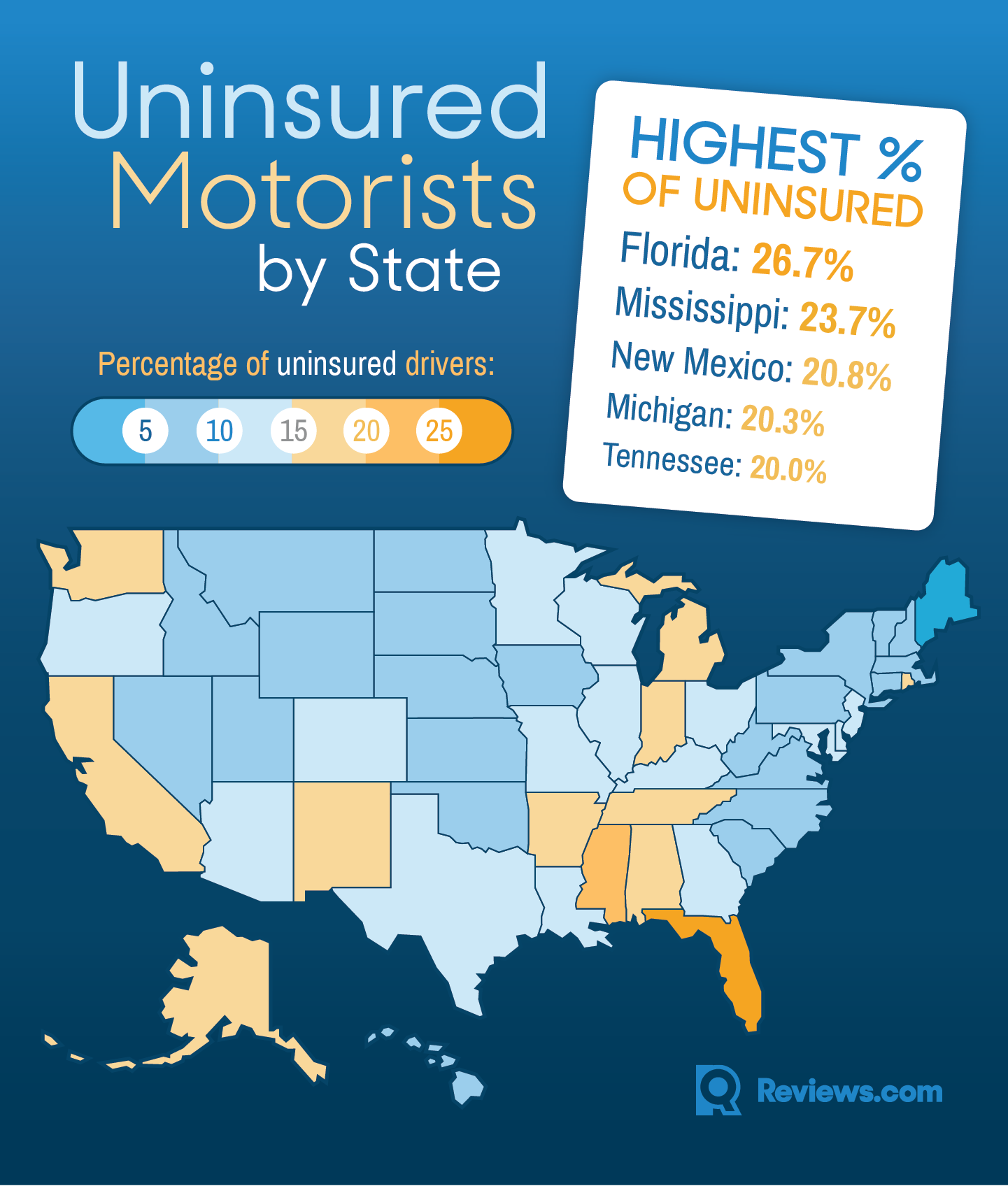

The best paying uninsured motorist insurance companies are The Hartford Nationwide Hanover Travelers and USAA. For example California only requires drivers to carry 15000 per person and 30000 per incident of bodily injury liability coverage. Underinsured driver coverage comes into play when you are hit by a driver is deemed at fault for the crash but whose liability insurance policy limits wont cover your medical bills your pain and suffering and other losses stemming from the crash.

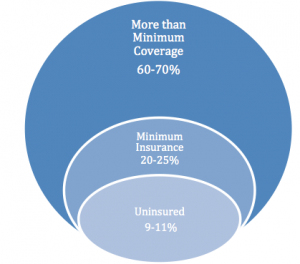

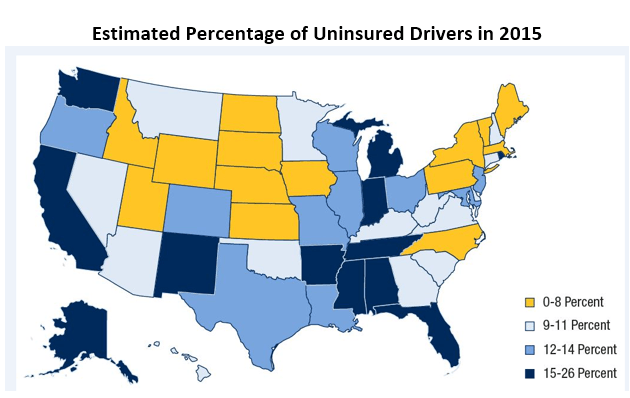

Uninsured motorist policies cover damages when the at-fault driver doesnt have insurance and after a hit and run. About 10 percent of Virginia drivers do not have auto insurance. Generally most insurance carriers do not permit you to carry more uninsuredunderinsured motorist coverage than you carry for your own liability.

A no-fault state means that no matter who was actually at fault for the accident it will be your insurance provider who will pay some or all of your medical bills and lost earnings. Do insurance companies go after underinsured drivers. It would create financial problems for the insurance companies.

The easiest way to collect damages following an automobile accident is through the other drivers insurance company. So whether the driver has insurance or not youll file the claim with your insurance company. If you are in a car accident with an insured driver whose policy does not cover the costs of the damages then underinsured motorist coverage will protect you in this instance.

The last thing you want to do after you get injured in a car accident is to fight with your insurance company over whether you have coverage or not. The Challenges of Being Hit by an Underinsured or Uninsured Driver Alabama is a fault or tort state when it comes to traffic accidents and insurance coverage.

Carrying Car Insurance Is Mandated By Law In Most States The Main Purpose Of Insurance Is To C Car Insurance Facts Car Insurance Best Auto Insurance Companies

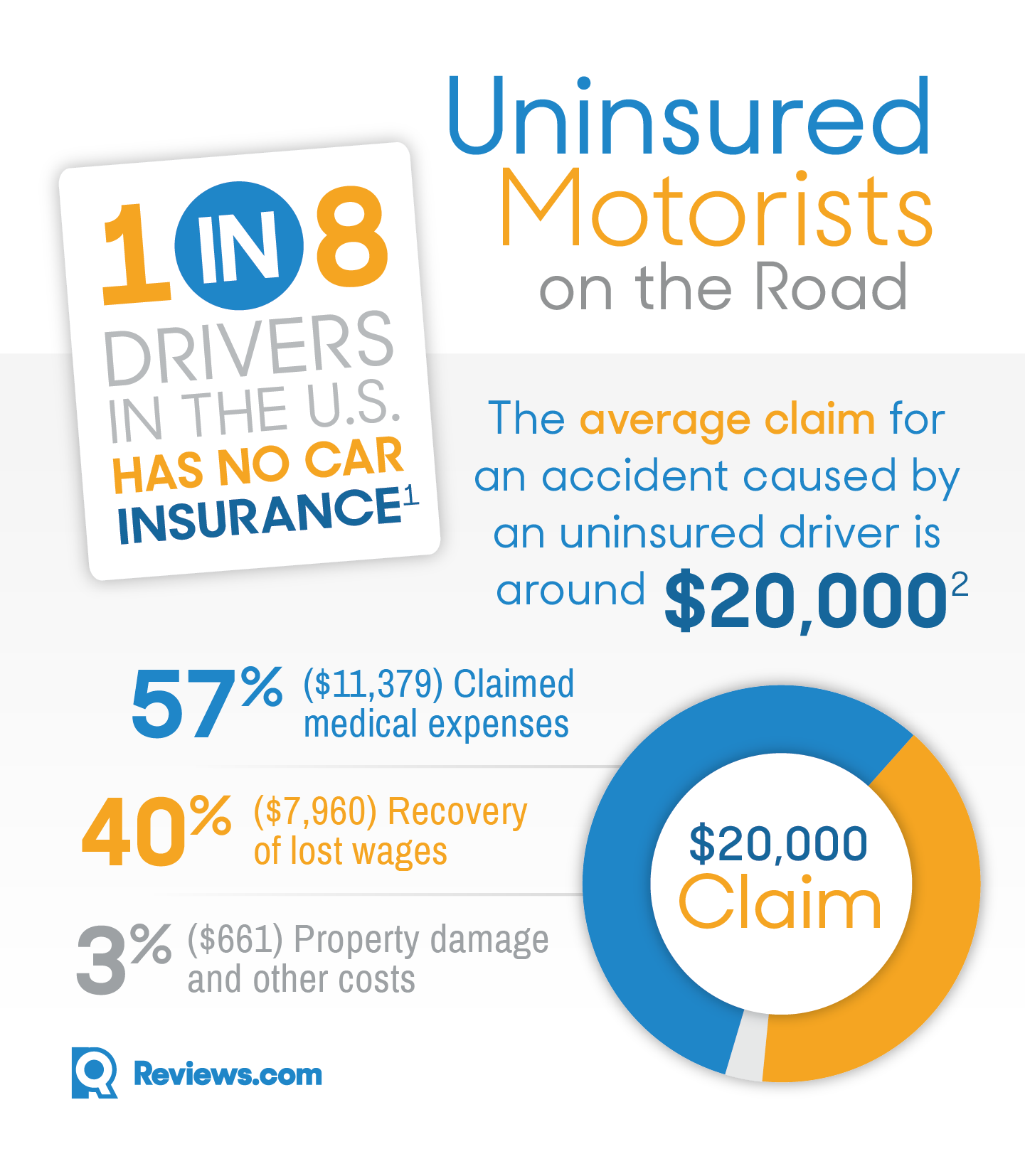

Why All Drivers Need Uninsured Underinsured Motorist Coverage Reviews Com

What Happens If You Get Hit By An Uninsured Driver In Texas D Miller Associates

What Happens When You Re Hit By An Uninsured Driver Car Insurance Car Insurance Tips Car Insurance Online

Uninsured And Underinsured Motorist Insurance Claims And Settlements

Best Cheap Car Insurance In Louisiana 2021 Forbes Advisor

Best Cheap Car Insurance In Alabama 2021 Forbes Advisor

Uber Drivers And Insurance Are You Covered Rideshare Driver Rideshare Car Insurance

How Much Uninsured Motorist Insurance Should I Get

Uninsured Or Underinsured Driver Accident Faqs Mayor Law

7 Types Of Car Insurance You Should Consider Infographic Auto Insurance Quotes Car Insurance Car Insurance Tips

Uninsured Motorist Coverage In Michigan What You Need To Know

Uninsured And Underinsured Motorist Coverage Um Uim And Why You Need It

In 5 States 20 Or More Of Drivers Have No Insurance Countrywide Average Increases

How Much Will Auto Insurance Increase After Accident Di 2021

Uninsured And Underinsured Motorist Insurance Claims And Settlements

What Type Of Motor Vehicle Insurance Do I Need Accident Insurance Car Insurance Insurance

Pin On I M Driving Uninsured We Can T Afford Our Vehicle Insurance Is It Nuts To Drive Out Of Town

Why All Drivers Need Uninsured Underinsured Motorist Coverage Reviews Com

Post a Comment for "Do Insurance Companies Go After Underinsured Drivers"