Annual Renewable Term Life Insurance Has Which Of The Following Characteristics

All of the following are characteristics of term insurance EXCEPT. Term life insurance guarantees a death benefit to your beneficiary for a set time such as 10 20 or 30 years.

Understanding Whole Life Insurance Dividend Options

A renewable term is a clause in many term life insurance contracts that lets you extend coverage without buying a new policy.

Annual renewable term life insurance has which of the following characteristics. Optional riders can be included. Term policies both annual ones and those with longer time periods have the following features. Annual renewable term ART is temporary protection for a duration of one year.

Term life is typically less expensive than a permanent whole life. Renewable term is still sold today but typically only as a method of renewing a level term life insurance policy. In an annual renewable term ART life policy the initial.

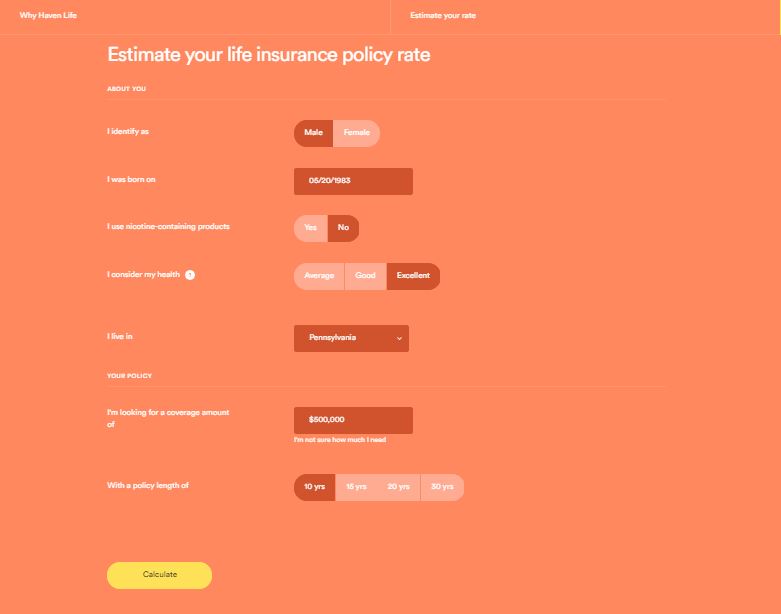

Term life insurance provides pure death protection pays a death benefit only. Whole life insurance permanent protection provides life insurance for the entire life of the insured. Choose a coverage amount and term length.

Annually Renewable Term A universal policy has two components. When insurance agents mention term life insurance they usually mean level term insurance. The insurance component or the death of a Universal Life Policy is always annual renewable term insurance All of the following are characteristics of a Universal Life policy EXCEPT.

While premiums are paid each year as if it were a one-year contract the premiums rise as a person ages. Annual Renewable Term ART life insurance is a life insurance plan that guarantees the insurer will provide coverage for a set number of years. If you pass away during this time your beneficiary receives money from the life insurance company.

Annual renewable term has. A Renewable to age 80 in New York B Fixed level death benefit for the term of the policy C Cash value D Conversion to a permanent policy without evidence of insurability 8. The perk with renewable term life insurance policies is that the insured has the option of renewing the policy without needing to provide evidence of insurability.

In general having a renewable term on a term life insurance policy provides peace of mind for the possibility of a worst-case scenario. Whole life insurance is a set amount of life insurance coverage that is meant to provide you coverage over the duration of your life. You pay a premium for a period of time typically between 10 and 30 years and if you die during that time a cash benefit is paid to your family or anyone else you name as your beneficiary.

Instead your coverage is automatically renewable by paying your premiums. An annual renewable term policy is a one-year life insurance policy with an option to renew at the end of each year. Ability to choose one or more beneficiaries.

Term life insurance has the following characteristics except. Coverage typically lasts for 10 to 30 years. With 1-year renewable term life insurance you will not need to take an exam or go through the life insurance underwriting process again.

An employee with 25000 group term life coverage was recently fired. How annually renewable term insurance works. At the end of this term period almost every company gives you the option to renew your policy without having to prove proof of insurability.

This employees group coverage may be converted to a. 125000 individual whole life policy 25000 modified whole life policy 25000 individual term life policy 25000 individual whole life policy. Term life insurance policies are renewable no matter how many years they are initially taken out for.

Unlike traditional term life insurance premiums start low and increase every time you renew your policy. It also is said to provide a living benefit because it accrues cash value which is available to the policy owner. Renewable term however has the same characteristics as a level term policy except renewable term life insurance has a typical policy period of one year.

An insurance component and a cash account. These renewable term life insurance policies make it possible for the insured person to carry on with their current policy with all of the benefits. Level term life insurance is a term life insurance policy with a set premium and death benefit.

When you purchase a term life insurance policy it will last for a specific term length usually from 5 10 15 20 and 30 years. A Level Term B Annual Renewable Term ART C Convertible Term D Increasing Term 7. These can be family friends or anyone else you choose.

Level term life insurance works much like other life insurance policies. A term life insurance policy is the simplest purest form of life insurance. Annual renewable term life insurance lets you lock in a period of insurability which is the length of time youll be able to renew the policy annually without reapplying or taking another.

While as with renewable term life insurance your costs after term conversion will be more than for your original policy your premiums will not go up each year as with an annual renewable policy. What Is Renewable Term Life Insurance.

Official Guide Types Of Term Life Insurance Quickquote

There Are Many Types Of Life Insurance Policies Which Are Available In The Uk Market Some Of Them A Life Insurance Quotes Life Insurance Policy Life Insurance

2 15 License Chapter 2 Part 1 Flashcards Quizlet

Term Vs Whole Life Insurance Policygenius

:max_bytes(150000):strip_icc()/lifeinsurance_92028809-ff7e776ca19c409480e1a4d6daf27379.jpg)

Annual Renewable Term Art Insurance Definition

Level Term Life Insurance Explained Life Ant

What Are The Three Main Types Of Life Insurance The Insurance Pro Blog

Annuity Vs Life Insurance Similar Contracts Different Goals

/GettyImages-462579193-536f61391d9142b8b97f39631fd4c34e.jpg)

Decreasing Term Insurance Definition

/GettyImages-170652637-781e681836e24c5fa50d1aad741ff981.jpg)

Level Premium Insurance Definition

Term Life Insurance Vs Whole Life Insurance Tal

:max_bytes(150000):strip_icc()/womansmilingwithcolleagues-9e313feaac144494868f71cd26eb7d5a.jpg)

What Is Annual Renewable Term Art Life Insurance

Doc Nature Of Life Insurance Do Hong Anh Academia Edu

/manwithsonandlaptop-b3e0b4a123824754bd4bc3a2833a48bf.jpg)

What Is Annual Renewable Term Art Life Insurance

:max_bytes(150000):strip_icc()/insurance-d9c977214d1f42b7bdfaf337d368e71e.jpg)

Annual Renewable Term Art Insurance Definition

What Are The Different Types Of Life Insurance Mason Finance

:max_bytes(150000):strip_icc()/guaranteed_vs_non_guaranteed_permanent_life_insurance_policies-5bfc375b46e0fb0083c3769b.jpg)

Post a Comment for "Annual Renewable Term Life Insurance Has Which Of The Following Characteristics"